- Analytics

- Market Overview

Important economic information is expected to come from the EU today - 28.3.2014

In the European Union an important economic information for the Euro (EURUSD) will be released today. Now it is near 3-week low due to regular statements of the ECB officials about the possible monetary policy easing. Macroeconomic indicators may clarify the state of the European economy. At 11-00 CET we will find out about the Eurozone consumer confidence and inflation rates in Spain and Belgium. At 14-00 СЕТ, the inflation in Germany strikes out. The same indicator for the EZ will be released on Monday. In our opinion low inflation can enhance the Euro. In general, Japanese economic data coincide with the forecasts. The Yen showed a slight weakening (growth on the USDJPY chart ) due to the increased individual inflation indicators. The PMI manufacturing index for March and Industrial Production for February are coming out in Japan on Monday night at 0-15 and 0-50 CET. Afterwards, we will see the real estate market indicators: construction orders and new buildings. We believe that the preliminary forecasts are generally in favor of the further weakening of the Yen. In the medium term it will depend on how soon the Bank of Japan will take measures of further monetary policy easing (including the emission volume increase). Earlier, the Japanese government adviser said that it could be in the middle of May. However, according to the polls of Western economists, there is a 37% probability of such easing occurrence at the end of June and 63% probability that it cannot happen before September. The British Pound (GBPUSD) rose yesterday for the fourth time in a row. Its strengthening occurred due to increase in retail sales in February by 4.2% on an annualized basis. Most of investors believe that the interest rates in UK will be increased in March 2015 by 0.25%. Today at 10:30 CET we will find out about the Q4 GDP in the third reading. It is expected to remain at 2.7% and it is unlikely to affect the exchange rate.

The Canadian Dollar has been strengthening for the sixth consecutive day. It looks like a fall on the USDCAD chart. In our opinion, the main reason for dynamics like this were the statements of the Bank of Canada governor, Stephen Poloz that his department is not going to lower interest rates and the economy will grow moderately over the long term. We do not exclude a technical upward correction on the CAD chart before the significant economic data release expected next week.

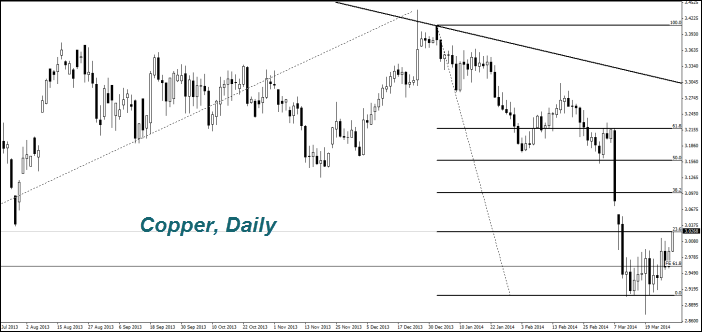

The (Copper) prices rising this week may be the highest for the last six months. As we have noted in previous overviews, the factor of decline in lending, secured by the Copper in China, gradually weakens its impact on the market. At the same time, the demand for the metal rose at construction companies. Chinese Prime Minister Li Keqiang said that the government is ready to assist industrial corporations amid slowing economic growth. One of the main measures among the others will be the infrastructure building in China (roads and water and electricity supply objects) at public expense. Sugar price rose due to information of launching the joint venture of Cargill, the major American agro trader and Copersucar, Brazilian sugar producer. The new company will become the world's largest sugar trader. Copersucar provides 10% of world sugar exports. Market participants believe that the purpose of the joint venture is to increase world sugar prices. Note that the new company may be launched before the end of the year.

See Also