- Analytics

- Fundamental Analysis

- Market Outlook 8 April

What to Trade Today?

Last night FOMC published its meeting minutes and shed more light on FED policy. Ahead of Mr. Powell's speech on IMF virtual meeting, now we know that FED, despite a positive outlook on recovery, still supporting the dovish policy, which is accepted as a supportive comment by market participants.

Treasury Secretary Janet Yellen, on the other hand, laid out a detailed program to raise corporate taxes to fund Biden's infrastructure spending plans, as he repeated his plans in his last night's speech again. President Biden also said that the U.S. would double its commitment to lowering carbon emissions.

Regulators in the U.K. and the E.U. have concluded a slight relation between AstraZeneca's vaccines and rare cases of blood clots on the vaccination front. However, both added the comments that the benefits of vaccination are much more than avoiding that.

Today's economic calendar is not too busy. Earlier, Germany's factory order on 1.2% monthly gain, realized in line with expectations, and a bit higher than a month ago. Later we are waiting for U.K. Construction PMI for March, and in the U.S. season, everything is about Jobless claims.

Stock Market:

In response to the news, U.S. futures hit new record highs. Earlier today, S&P 500 extended its gains above 4,090 to print new records. However, it seems the main U.S. indices are lowering from their O.B. areas. SP500 lowered under R2 at 4,088 trading towards R1 at 4,081. The following targets seem at P.P. at 4,069 and then S1 at 4,061, S2 at 4,050.

Fx Market (H1 Chart)

EURUSD: Trading at its P.P. (18.80) and above both 20 and 50 HMA, R1, and Key resistance at 1.1900 will clear the trend. Breathing above R1 will open the doors for higher numbers. On the other hand, as USD again started weakening by gains in stock markets. On the other hand, stocks seem to be lower today, as profit-taking is one of the first ideas in such a higher price level. So, we are expecting to recovery in USD, which will weigh on EURUSD. On the other hand, we are waiting for ECB meeting minutes, which is expected to push the EUR to a lower area. ECB's comment is about keeping long-term interest rates low.

USDCHF: For the same reason of rebounding of USD, plus technically stochastic has the second signal for correction, as mainline crossing the signal line from down; however, since the EMA crossing strategy still supporting the downtrend, the position seems to be a bit risky. 0.9294 is the P.P., and breathing above this level can signal the following targets at R1, 2 and 3, respectively at 0.9320, 0.9342, and 0.9368.

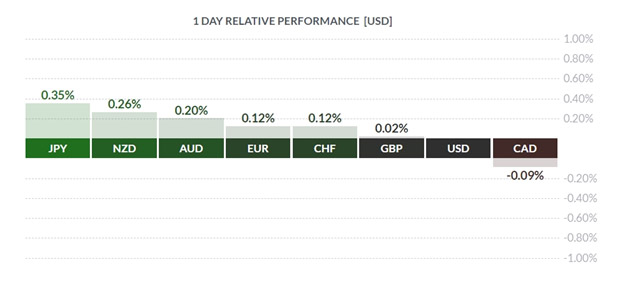

On other currencies: Today, JPY, after the weakening of Nikkei 225, is gaining against its crosses, so it must be "buy" for now. AUD and NZD are also getting more demand after raising in Chines stock markets.