- Analytics

- Market Overview

The U.S. Dollar Index fell due to negative macroeconomic data on Thursday - 14.2.2014

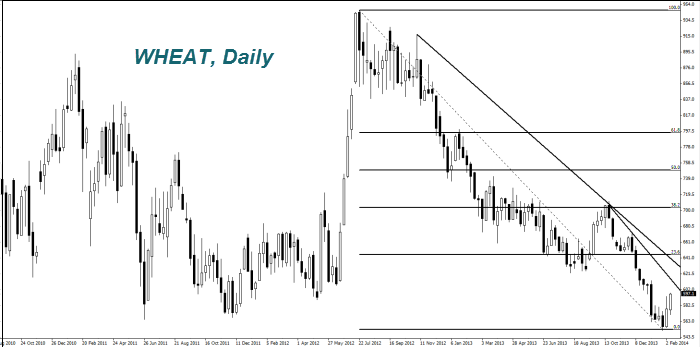

The Euro (EURUSD) appreciated yesterday (growth on the chart ) due to the weak U.S. statistics. Today, investors will be focused on the EU's GDP for the fourth quarter, which will be released at 10-00 GMT (0). Earlier, the head of the ECB, Mario Draghi said that this information may confirm recovery of the European economy. The expected GDP growth is 0.4%. However, we do not exclude that good the data can move the euro down on the chart. Some investors believe that the ECB is interested in a weak currency for continued economic growth and may cut interest rates at its meeting on March 6. The Pound (GBPUSD) rose yesterday to the three-year maximum. Besides the weak U.S. and strong British macroeconomic data, this is due to a noticeable difference in the yields of government bonds of two countries. The spread is at its maximum from the middle of 2010, which makes the pound more attractive. In our opinion, this may make the British currency locally overbought. Any macroeconomic negative is able to make it fall As it was expected, there is a good rise in wheat prices (WHEAT) after lowering its forecasts on its reserve by the USDA due to too cold weather. This week, the Ministry published a forecast of wheat exports - 626.6 thousand tons. It coincided with the market expectations. The cost of soybean (Soyb) rose on expectations of increased demand from China. Meanwhile, the USDA predicts an increase in soybean acreage from 76.5 million acres to 78 million. As a result, the crop in 2014/15 could reach 3.48 billion bushels. This, according to U.S. Department of Agriculture, will lead to significantly lower prices.

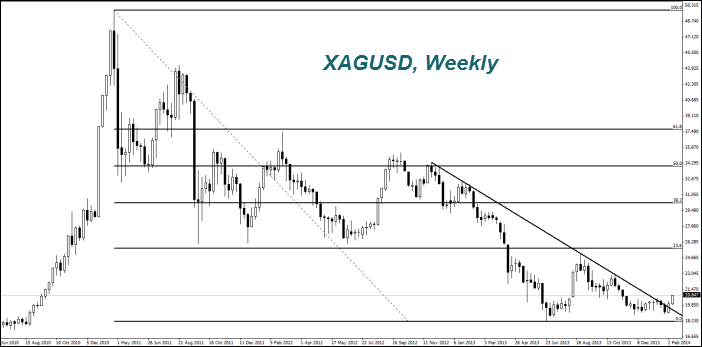

The price of Gold (XAUUSD) and Silver (XAGUSD) dramatically improved on the weak U.S. economic data has. Investors see Gold (XAUUSD) and Silver (XAGUSD) as defensive assets. Silver gets expensive for ten days in a row for the first time since March 2008. Gold went up by 8.6% and exceeded $ 1,300 per ounce for the first time in three months since the beginning of 2014. Meanwhile, a number of major Western banks expect the Gold price to drop in the area of $ 1050 per ounce by the end of this year due to continued economic growth in the U.S. and Europe. The main demand for precious metals is now concentrated in the developing countries, China and India.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also