- Analytics

- Market Overview

On Friday, the Eurozone GDP increased in the fourth quarter more than it was expected - 17.2.2014

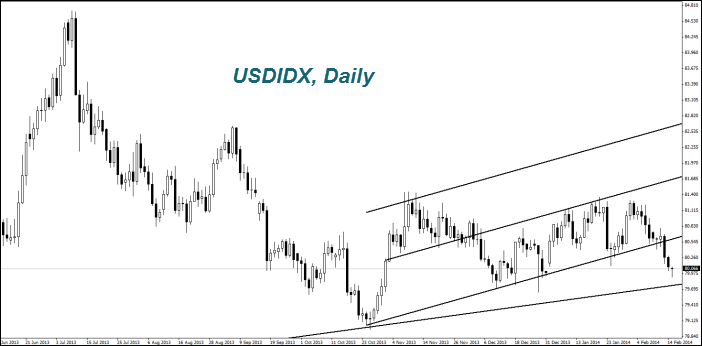

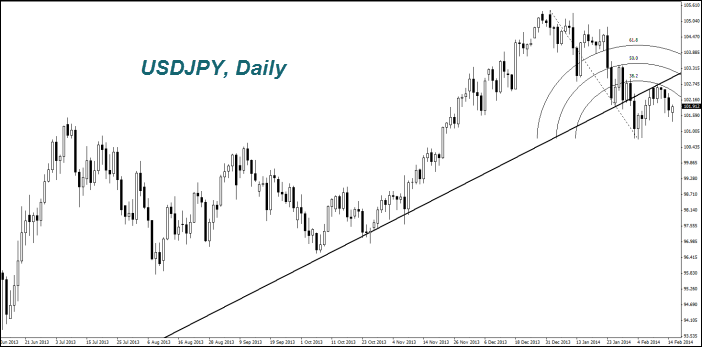

Last night, there was the Japanese GDP for the fourth quarter declared. It was worse than the preliminary forecasts. Because of this, strengthening of the Yen (falling on the USDJPY chart) was not that significant. Market participants fear increase of the monetary issue. The Bank of Japan is doing as same thing as the Fed does - prints money and spends them for monthly Japanese government bonds. However, as we have already mentioned, further easing of the monetary policy in Japan is unlikely until early April, when the sales tax is increased from 5% to 8%. The authorities will firstly need to assess the impact of this increase on the economy. It will happen for the first time since 1997. This week will be eventful for the Yen. Tomorrow at 3-30 - 5-00 GMT (0) we expect the Bank of Japan important press conference to be held. On Wednesday and Thursday there are macroeconomic data coming out. The Australian Dollar (AUDUSD) rose (growth on the chart) due to the positive data from its main trade partner - China. The volume of new loans reached its highest level since 2010 and amounted to 1.32 trillion Yuan. Most of the Forex market participants believe that the Reserve Bank of Australia will not reduce the interest rate (2.5%) until the end of the year. An additional positive factor for the Australian dollar was the CFTC report. The net short position on Aussie decreased by 14.6% last week. Tomorrow at 00-30 GMT (0) we expect the RBA press conference to be held. There are no more particularly meaningful data from this country expected this week.

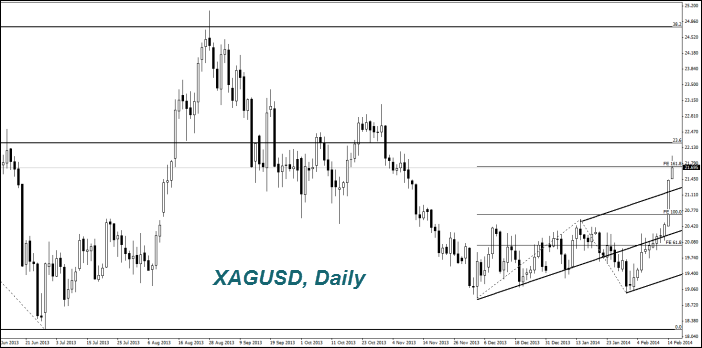

The price of Gold keeps rising on weak economic data from the United States, the increase in the (XAUUSD) quotations is also observed. According to the CFTC weekly report, the net long position on Gold futures in the Chicago Stock Exchange increased by 17%. The number of buyers increased by 8.8%. Due to rising in the Gold price, there was a strong growth of Silver (XAGUSD) quotations occurred. They rise for 12 consecutive days, for the first time since 1968. The rest of the precious metals are also in high demand.

News

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also