- Analytics

- Market Overview

Market participants expect Fed meeting results tomorrow - 29.7.2014

World stock indices drifted to the sideways trend on Monday. The U.S. macroeconomic data disappointed investors, but it did not lead to a price drop. Market participants expect the results of the Fed meeting tomorrow and take their time to do a deal. The trade turnover on U.S. exchanges was average for the month and amounted to 5.5 billion stocks.

Existing Home Sales in June fell unexpectedly 1.1%. The number was to be increased 0.5% for the third consecutive month, according to forecasts. This negative data was partially smoothed by the Service PMI growth in July to its 4.5 year high and amounted to 61 points, submitted by the company Markit. Herbalife submitted the report and informed on profit reduction by 17% after trade closing. As a result, its stocks slumped 10.2% in the additional trading session. Now the U.S. futures on stock indices are "in the red." Today at 14-00 CET Consumer Confidence Index for July is to be released in the United States. The outlook seems to be positive. Also Anadarko Petroleum, BP and other companies will show their earnings reports.

European stock prices did not have any single trend. Stock drop of the companies with a considerable involvement in Russian business, such as Daimler, Porsche, Raiffeisen Bank and others was the result of the sanctions imposed. Danone and other food manufacturers’ quotes rose due to their good earnings reports. The sideways trend is maintained today. Especially significant macroeconomic data is not expected in the EU.

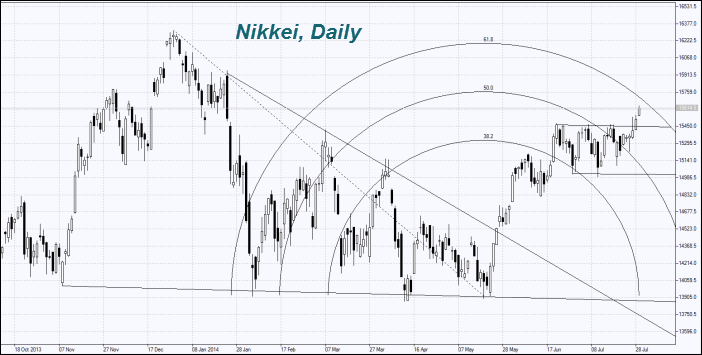

Nikkei continued to grow. As we have already pointed out in the previous overviews, it was in the sideways trend from mid-June and has considerably fallen behind the raised U.S. and European indices. Nissan Motor and Keyence Corp. good reporting contributed to the current index growth: the stocks of other Japanese exporters rose in prices as well following the reporting. The statements outperformed the weak economic data on Unemployment and Retail Sales. Tonight at 23-50 CET Industrial Production in Japan in June is to come out: the forecast seems to be positive.

Gold prices increased slightly following the significant slump as the Dollar and global stock indices rose over the previous few days. The weekly volume of net-long positions rose 3.1%, according to the CFTC. This was facilitated by the growing global political tension following the third phase of sanctions imposed by the western countries against Russia. Oil prices are rising for the same reason today. Russia is the third world oil producer. The weekly U.S. oil inventories forecasts are considered to be an additional factor for the price growth. A decrease of 1 million barrels and an increase in petrol and distillate inventories are expected. The official data will be released on Wednesday.

The price of natural gas dropped. The weekly volume of net-long positions fell 11%, according to the CFTC. Gas is widely used to produce electricity. Electricity generation slumped 11% in mid-July, compared with the previous year, and has reached the lowest level since 2001, according to Edison Electric Institute. The delivery volume of natural gas to power plants has fallen 13% to its low since 2009, according to LCI Energy Insight. Weak demand for electricity can be explained by the fact that the current July is the coldest in the U.S. in five years. Due to this the residents are not likely to switch on the air conditioning. Meanwhile, a number of market participants assume that gas starts competing with coal as a fuel resource, considering its price 3.75-3.5 per million BTU. Therefore, these levels may be considered as a "technical support".

USDA lowered the rating of crop quality for the first time in five weeks. For this reason futures on grain and soybeans jumped. China purchased 486,000 tons of U.S. soybeans, as announced by USDA. Soybean exports to China in mid-July tripled compared with the previous year and amounted to 2.68 million tons. Note that the Commodity Weather Group LLC forecasts cold and dry weather in the U.S. this week. So the grain prices might continue to grow.

News

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also