- Analytics

- Market Overview

The world stock markets kept falling on Friday - 4.8.2014

The world stock markets kept falling on Friday. This was caused by the negative economic information from the U.S. labor market for July. The number of new jobs in the non-agricultural sector rose by 209 K. This is much lower than the forecast of 250 thousand. The unemployment rate for June rose to 6.2% from 6.1%.

The U.S. labor market data strongly influence financial markets. Since the Federal Reserve takes the their dynamics into account making a decision regarding the monetary policy. The S&P 500 fell by 2.7% within a week, showing the biggest decline since June 2012. The downtrend is accompanied by the trading volume increase. On Friday, it was 20% higher than the monthly average on the U.S. stock exchanges. The U.S. stock index futures are trading higher due to the good Procter & Gamble report and the growth of the ISM industrial activity index to its 3-year high. The data came out on Friday, but did not affect the investors at that time. There is no significant macroeconomic information expected to come out in the United States for today.

European stock indexes also fell on Friday, along with the U.S. indexes. The additional negative factors were: the Portuguese bank Banco Espirito Santo report of the loss in the amount of $3.6 bln. EUR, possible losses of European companies due to the expansion of sanctions against Russia, as well as the default threat in Argentina. European stocks are growing today. The Portuguese Central Bank has decided to provide the financial support for Espirito Santo amounted to 4.9 bln. EUR. Today, at 9:00 am CET, we expect the EU PPI for June. The forecast is neutral.

The Nikkei has been falling for the third session in a row, along with other world stock indices. Tomorrow night, at 1-35 CET, Japan will release two indexes from Markit and JMMA such as the composite PMI and in the services PMI. The similar Chinese indexes calculated by the HSBC bank are expected to be announced at 1-45 CET. They can affect the commodity futures, since China is the largest consumer of raw materials in the world.

The Copper price fell. The American company, Freeport-McMoran announced the resumption of exports from Indonesia. The first part of metal of 10 000 tons is sent to China. In the first half of the year, the copper export was not carried out due to negotiations between American companies and the Indonesian government concerning the increase in fees. Now, when the parties have agreed, Freeport-McMoran is going to take 756 000 tons of copper out before the end of the year. An additional factor influencing the price downfall could be the message about financing the investment program of the world's largest copper producer - Chile's Codelco's by the Chilean government in the amount of $4 bln. till 2018.

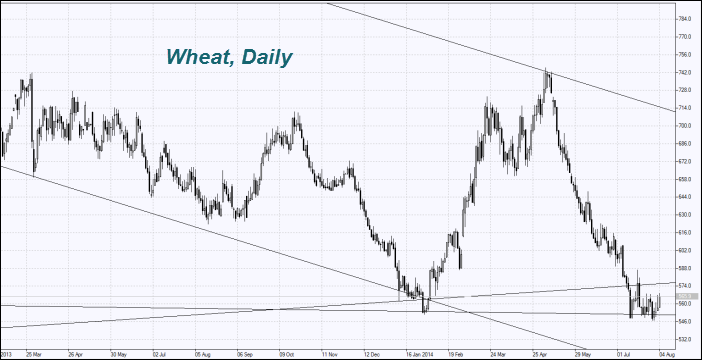

The Wheat has been coming expensive fourth days in a row. The Francois Luguenot and ADM Germany GmbH agencies announced a possible crop quality decline in Germany and France because of the drought. In addition, some market participants fear that the Western sanctions can reduce the grain exports from Russia.

The Gold prices showed a weak growth due to the falling global stock indices. Precious metals are considered as safe heaven and they usually come more expensive in case of the negative financial markets dynamics. Probably, some investors believe that the Gold may look less attractive in case of a rate hike in the United States. According to the CFTC, the net-long on the Gold decreased by 10% within a week, while the total short position increased by 24% to the maximum of 5 weeks. The premium between the Gold prices in China and London was reduced to $3 per ounce from $20 at the beginning of the year.

The net shorts on the Cotton reached the 5-year maximum last week. Meanwhile, its quotations have been growing for the second consecutive day. The International Cotton Advisory Committee raised its forecast for the global Cotton demand within the season 2014/2015 to 24.5 million tons from 23.3 million tons in 2013/2014 season. The Committee also believes that the production for the season 2014/2015 reduced to 25.5 million tons from 26.13 million tons. Nevertheless, the global reserves are expected to increase by 5.3% to 21.7 million tons due to the decrease in export-import operations.

News

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Oil Prices Stay Weak After OPEC+ Approves Modest Output Rise

Oil prices ended the week on shaky ground after OPEC+ approved a modest production increase of 137,000 bpd, signaling cautious...

Slowing U.S. Growth Put Spotlight on CPI as EURUSD

Weak PMI data, softening jobs market, and political brouhaha raise the stakes for October’s inflation print. The U.S. government...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also