- Analytics

- Market Overview

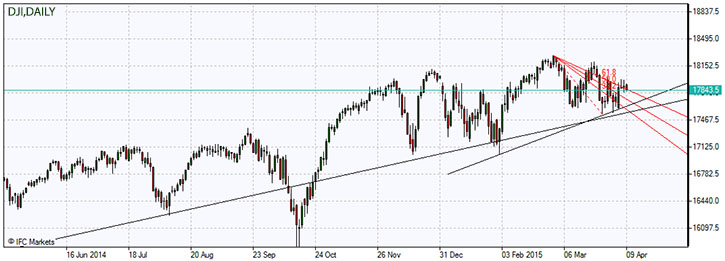

Fed minutes reveal policy makers favor earlier rate hike - 9.4.2015

US stocks closed slightly higher on Wednesday as investors digested the Federal Reserve March meeting minutes. The records showed several policy makers had favored a rate hike in June, while acknowledging the slowing of economy in the first quarter and risks from slowing global growth. The US dollar rose against major currencies, the ICE US Dollar Index was up 0.25% at 98.0790 on Wednesday. Market sentiment was supported by new merger deals as Mylan NV announced it proposed to acquire Perrigo Co. for about $29 billion in cash and stock. Shares of both companies jumped 15% and 18% respectively. The S&P 500 closed up 0.3%. After the market closed, Alcoa Inc reported first-quarter revenue that missed Wall Street estimates. Today at 13:30 CET February Initial Jobless Claims and Continuing Claims will be released in US. The tentative outlook is negative. At 15:00 CET February Wholesale Inventories and Trade Sales will be published. The tentative outlook is positive.

European stocks inched higher on Wednesday as merger deal activity lifted energy shares. Royal Dutch Shell Group PLC said it would buy BG Group in a deal worth nearly $70 billion. The Stoxx Europe 600 closed up 0.1%. Germany's DAX fell 0.7 percent as auto shares declined on concerns of overly high valuation ratios after sharp gains this year driven by boosted earnings prospects due to weaker euro. BMW fell 1.4 % while Daimler retreated 1.3 %. The euro fell against the dollar, and given the divergent monetary policies of the Fed and European Central Bank the trend will likely continue. Today February German Industrial Production came in weaker than expected, while Trade Balance improved. No other important economic data are expected today in euro-zone. At 9:30 CET February Trade Balance will be released in UK. The tentative outlook is negative for the Pound. At 12:00 CET Bank of England Rate Decision will be announced, no change in policy is expected.

Nikkei hit a fresh 15-year high on Thursday as investor optimism was bolstered by Finance Ministry data showing that foreign investors bought a net 1.036 trillion yen ($8.61 billion) of Japanese shares last week, their biggest net buying since early April 2013. At the same time Japanese investors bought a net 424.4 billion yen of overseas equities and investment funds, up from 396.1 billion yen in the previous week. Tomorrow at 0:50 CET in the morning March bank lending data will be released, the tentative outlook is positive for yen.

Tomorrow at 2:30 CET official inflation data will be released in China. The tentative outlook is negative.

Oil prices plummeted on Wednesday as US Energy Information Administration report indicated US oil inventories posted the largest one-week jump since 2001. The increase in inventories was accompanied by 18,000 barrels a day US output rise to 9.404 million barrels. Brent crude for May delivery on London’s ICE Futures exchange dropped 6%. Oil was already under pressure after Saudi Arabia reported record output in March.

Gold prices retreated on Wednesday as the minutes from the FOMC March policy meeting indicated several policy makers were considering interest rate hike as early as June.

Copper futures fell 1.1%, the most in a week, as the prospect of earlier rate hike favored by several Fed officials provided support for the dollar rebound, curbing the appeal of commodities as alternative investments.

See Also