- Analytics

- Market Overview

Some agricultural futures reached the multi-year low - 11.9.2015

The US stock market was on increase on Thursday due to the positive corporate news. The markets are in the neutral trend for two weeks already waiting for the Fed decision on its meeting September, 17. The US Dollar Index fluctuates in quite a narrow range. Yesterday, the Apple shares advanced 2,2% before the new iPhone and iPad presentation. The shares of the Gilead, biotechnological company, gained 3,3%. The macroeconomic data were neutral. The trade volume on the US stock exchanges was 16% lower yesterday than the last 20 sessions average and totaled 6.8 bln. shares. Today at 13:30 the US PPI (producer price index) for August is to be released and at 15:00 the University of Michigan confidence index for September is to come out. The tentative outlook is negative.

The European stock indices are on decline today following the yesterday’s growth. The market is, in general, in the neutral trend waiting for the Fed meeting results. Moreover, the European investors would like to get the more definite evidence of the Chinese economy recovery after the Bank of China provided additional monetary stimulus to it. The Euro demonstrated the sluggish growth within the neutral trend. The shares of E.ON, energy producer, were 2.6% down and reached the 20-year low after ditching a plan of spinning its nuclear plants off. Now its expenses will grow on the need to handle and close the NPPs. The British telecommunication companies Vodafone and BT Group have lost 1.6%. Investors are concerned by the possible taboo on the further sector consolidation after the European Commission prohibited the merger of the two Scandinavian telcos. Today in the morning the Gernab inflation in August was released which confirmed the forecast. No more important statistics is expected from the EU.The Nikkei index went a bit down today staying in the neutral trend. According to the Japan Exchange Group, the foreign investors are the net sellers of the Japanese stocks for four weeks in a row already. The Yen weakened within the neutral trend due to the prime-minister Abe statement on the possible further loosening of the monetary policy which implies the additional Yen emission. The matter is to be discussed on the Bank of Japan meeting on October, 30. Next Tuesday the Bank of Japan announce and the speech by its head Haruhiko Kuroda are expected.

On Sunday some important Chinese macroeconomic indicators are to be released, which may influence the commodities futures. Those are new loans in Yuans, industrial production, retail sales and others. The new loans are expected to have contracted while the other indicators to have grown.

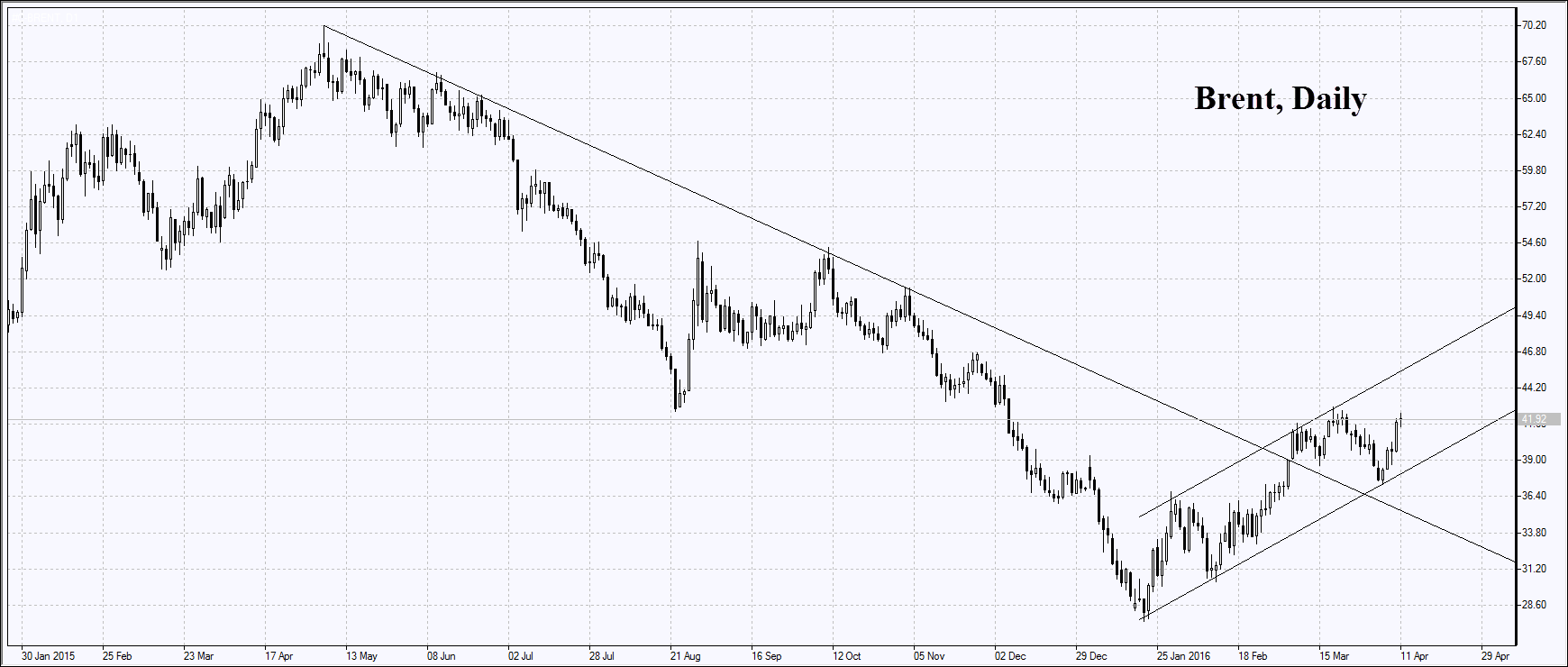

Crude oil is in the neutral trend for more than a month. Today its price went down on the negative review by the Goldman Sachs investment bank, which has downgraded the average expected WTI price in 2015to $48.1 from $52 per barrel and in 2016 to $45 from $57. For Brent the outlook was revised down from $58.2 to $53.7 per barrel in 2015 and from $62 to $49.5 in 2016. The additional negative was the Saudi Arabian statement on no need of convocation of the extraordinary OPEC meeting due to the low oil prices.

The soy quotes are on a slight increase before the today’s release of the US Agricultural Ministry report for September at 17:00 CET. The markets expect the production outlook in 2015/2016 and the stock in 2014/2015 to be revised down. In this case, the soy may begin its first growth in 5 weeks. The weekly increase of the wheat and corn prices is 2% and 3% respectively. Let us remind you that the grains are currently being near their 6-year low.

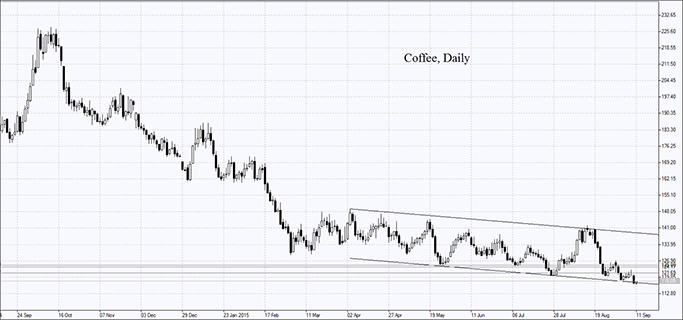

The coffee price has posted a year and a half low due to the weakening Brazilian Real which has hit its low since October 2002 when Standard & Poor agency cut the country’s rating to the default level. Investors expected the massive coffee export for selling the product in US Dollars on the world market. It is hard to predict what is going to happen. The coffee export in April-August of the present year has contracted by 4.6% compared to the same period of the previous year.

News

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric social hub it turned into a data collecting and selling...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving mostly because of a small group of very large tech companies...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also