- Analytics

- Market Overview

US broad stock market edges higher - 27.9.2017

Technology shares recover pushing US market higher

US stocks inched higher on Tuesday as Federal Reserve chair Janet Yellen reiterated the case for further rate increases. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 92.99. The S&P 500 added 0.3 points settling at 2496.84, led by technology stocks. Dow Jones industrial average slipped less than 0.1% closing at 22284.32, posting fourth straight daily loss. The Nasdaq composite index gained 0.2% to 6380.16 helped by 1.7% gain in Apple shares.

Treasury yields inched higher as Yellen said the Fed should be wary of “moving too gradually” as this may result in rising wages, causing accelerating inflation. Yellen’s hawkish comment in a speech in Cleveland reinforced the case for another rate hike this year: fed funds futures traders are pricing in a 78% chance of a third rate hike this year, compared with a 72% chance on Friday, according to CME Group’s FedWatch tool. In economic news, Case-Shiller US home price index rose 5.9% in July, compared with a 5.8% increase in June. However, August new home sales slipped to an annual rate of 560,000 from 580,000 reported in July.

European stocks extend gains

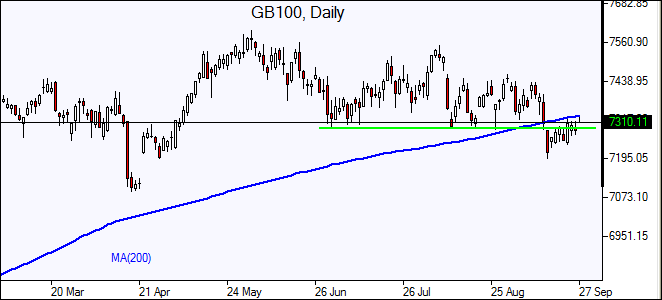

European stocks closed marginally higher on Tuesday in cautious trade. Both the euro and British Pound extended losses against the dollar. The Stoxx Europe 600 inched 0.03% higher. Germany’s DAX 30 gained 0.1% closing at 12605.20. France’s CAC 40 closed marginally higher while UK’s FTSE 100 fell 0.2% to 7285.74. Markets opened 0.2%-0.4% higher today.

Asian markets mixed

Asian stock indices are mixed today as traders await more direction clues after lackluster Wall Street session overnight. Nikkei fell 0.3% to 20267.05 despite continued yen weakening against the dollar. Stocks slipped on ex-dividend price adjustment as the first half of the fiscal year ends on Saturday for interim dividend payments by many Japanese companies, and shareholders as of Tuesday’s close were entitled to those dividends. Chinese stocks are higher: the Shanghai Composite Index is 0.1% higher and Hong Kong’s Hang Seng Index is up 0.5%. Australia’s All Ordinaries Index is down 0.1% despite weaker Australian dollar against the greenback.

Oil slips ahead of US inventory report

Oil futures prices are lower today ahead of official US crude oil inventory report. The American Petroleum Institute industry group reported late Tuesday US crude stocks fell by 761 thousand barrels last week as refinery crude runs rose by 1.3 million barrels per day. Prices fell yesterday on expectations of higher US inventory: SP Global Platts survey forecast 1.3 million barrels rise. November Brent crude fell 1% to $58.44 a barrel on London’s ICE Futures exchange on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also