- Analytics

- Technical Analysis

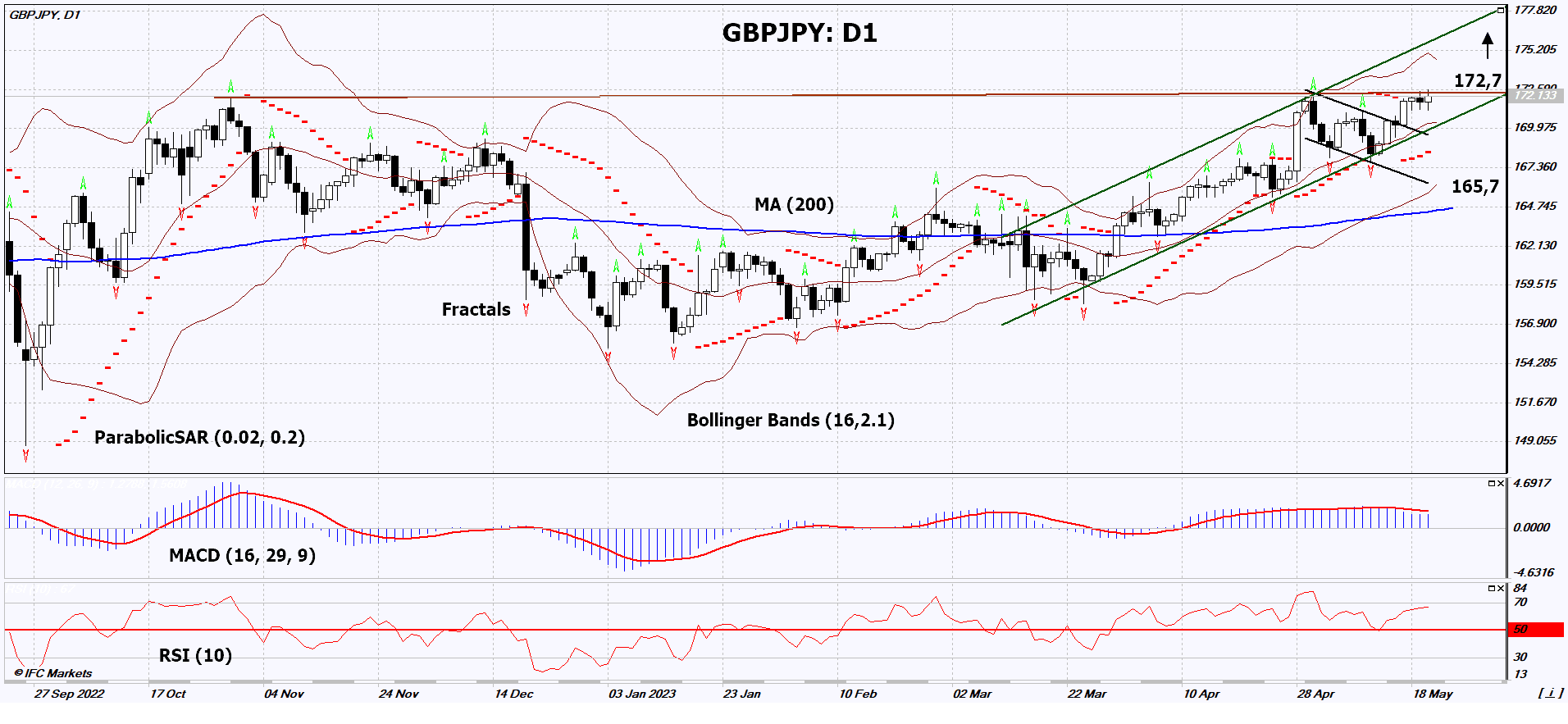

GBP/JPY Technical Analysis - GBP/JPY Trading: 2023-05-23

GBP/JPY Technical Analysis Summary

Above 172,7

Buy Stop

Below 165,7

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

GBP/JPY Chart Analysis

GBP/JPY Technical Analysis

On the daily timeframe, GBPJPY: D1 is in a rising channel. It has broken out of a bullish flag and approached a strong resistance level. This level should be broken upward before opening a position. Several technical analysis indicators have generated signals for further upward movement. We do not exclude a bullish movement if GBPJPY: D1 rises above the last two fractal highs and its recent maximum at 172.7. This level can be used as an entry point. The initial risk limitation can be set below the Parabolic signal, the last two fractal lows, and the lower Bollinger Band line at 165.7. After opening a pending order, we move the stop loss along with the Bollinger Band and Parabolic signals to the next fractal low. This way, we adjust the potential profit/loss ratio in our favor. More cautious traders, after entering the trade, can switch to the four-hour chart and set a stop loss, moving it in the direction of the trend. If the price exceeds the stop level at 165.7 without activating the order at 172.7, it is recommended to cancel the order as internal market changes that were not taken into account may occur.

Fundamental Analysis of Forex - GBP/JPY

Japan and Britain are expected to publish important economic data. Will GBPJPY quotes continue to rise?

Upward movement implies a weakening of the Japanese yen against the British pound. Last week, inflation unexpectedly rose in Japan for April, reaching 3.5% y/y, higher than the expected 2.5% y/y. On May 22, Japan's Core Machinery Orders for March plunged by -3.5% y/y, contrary to the expected growth. On May 23, a group of economic activity indicators will be released in Japan, including the Jibun Bank Manufacturing PMI. On May 25, Tokyo's inflation data for May will be published, which could provide further insight into the forecast for Japan's overall inflation, to be released on June 22. The majority of forecasts appear somewhat negative for the yen. In Britain, there will also be significant statistics this week. On May 23, the S&P Global/CIPS UK Manufacturing PMI will be released, followed by inflation on May 24, and retail sales on May 26. Additionally, this week will feature a speech by the Governor of the Bank of England (BoE). Market participants hope that the data will increase the likelihood of a rate hike (+4.5%) by the BoE at its next meeting on June 22. It's worth noting that the Bank of Japan's rate has been negative since January 2016 (-0.1%), and its next meeting is scheduled for June 16.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.