- Analytics

- Technical Analysis

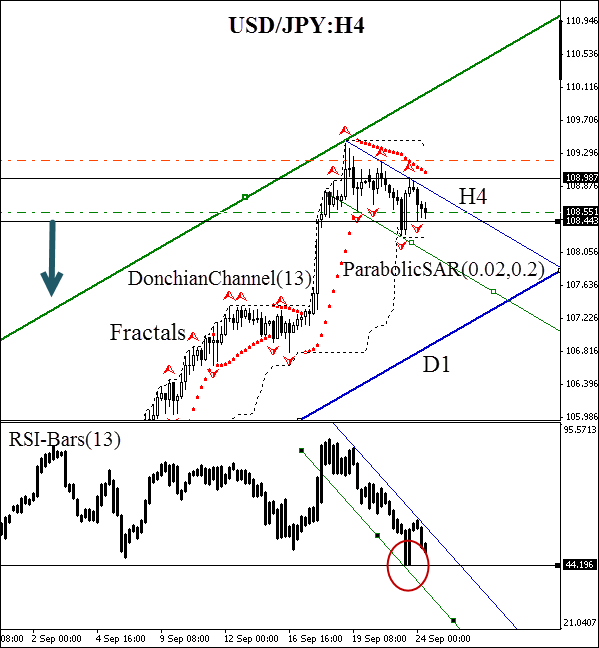

USD/JPY Technical Analysis - USD/JPY Trading: 2014-09-24

New Home Sales: yen retracement anticipation

Good afternoon, dear traders. Today at 16:00 CET the US Census Bureau publishes New Home Sales, data on the number of new housing sold per 1 family over the past month in the United States. The indicator is calculated annually. It is considered to be the leading indicator of economic development, as it has a multiplicative effect on various economic sectors: mortgages, insurance contributions, furniture, electronics, etc. We suppose that major investors would react to macroeconomic data, and that allows us to count on an additional volatility momentum of the US dollar against other liquid currencies.

After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day after the formation of 5 new H4 candlesticks, needed for the Bill Williams fractal formation. Thus, we are changing the probable profit/loss ratio to the breakeven point.

| Position | Sell |

| Sell stop | below 108.443 |

| Stop loss | above 108.987 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.