- Analytics

- Market Overview

Fed Chair nominee Powell testifies - 28.11.2017

Dow advances while SP 500, Nasdaq slip

US stocks slipped on Monday as losses in energy shares offset gains in retailers. The dollar strengthened supported by home sales data and hawkish comments by Dallas Fed President Rob Kaplan: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 92.887. S&P 500 closed 0.2% lower settling at 2601.42. The Dow Jones industrial average meanwhile rose 0.1% to 23580.78. The Nasdaq composite index lost 0.2% to 6878.52.

Treasury yields declined as Senate resumed tax plan deliberations. Concerns republicans’ slim majority in the Senate makes the tax plan’s passage far from certain undermine investors confidence. However data showing new home sales hit an annual rate of 685 thousand in October, above an expected 627 thousand, and a comment by Dallas Fed President Kaplan an interest rate hike “will likely be appropriate, in the near future” supported the dollar. Traders will focus on a confirmation hearing for Jerome Powell, President Donald Trump’s nominee to replace Fed Chairwoman Janet Yellen scheduled at 14:45 CET today for additional clues on future Fed policy.

Bank stocks lead European markets decline

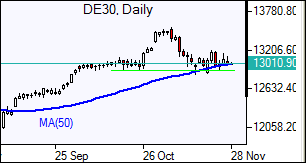

European stocks further retreated on Monday led by bank shares. Both the euro and British Pound fell against the dollar. The Stoxx Europe 600 index ended 0.5% lower in a choppy trade. The DAX 30 fell 0.5% to 13000.20. France’s CAC 40 lost 0.6% and UK’s FTSE 100 finished 0.4% lower at 7383.90.

The agreement by Social Democrats in Germany to hold talks with other parties about forming a government spurred hopes a coalition German government may yet emerge without a need for a snap election. Forming of a German coalition government will boost euro.

China concerns weigh on Asian markets down

Asian stock indices are mixed today with concerns about volatile Chinese markets weighing on market sentiment. Nikkei closed less than 0.1% higher at 22502.00 helped by a weaker yen against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is 0.3% higher while Hong Kong’s Hang Seng Index is down 0.4%. Australia’s All Ordinaries Index is 0.1% lower as Australian dollar rebounded against the US dollar.

Oil edges lower

Oil futures prices are inching lower today as TransCanada said it would restart the 590,000 barrel per day Keystone pipeline to US at reduced pressure later on Tuesday. Prices edged lower Monday on doubt over an extension to a productions cut deal at the OPEC November 30 meeting. January Brent crude settled at $63.84 a barrel on Monday.

See Also