- Analytics

- Market Overview

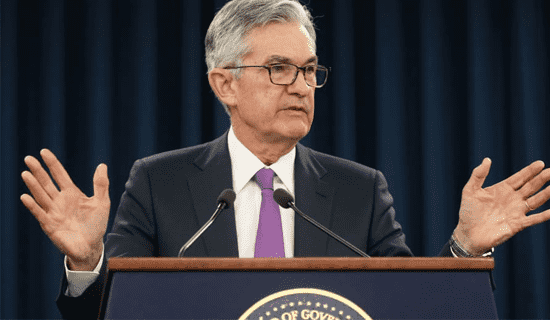

Stocks mixed as Wall Street sells off ahead of Fed meeting - 21.9.2021

Todays’ Market Summary

- The Dollar strengthening has halted currently

- Futures on three main US stock indexes are up currently

- Gold prices are edging lower currently

Top daily news

Forex news

The Dollar strengthening has halted currently . The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, added less than 0.1% on Monday as National Association of Home Builders reported builder confidence inched up in September.

Both GBP/USD and EUR/USD continued retreating Monday while federal statistics office Destatis reported German producer prices inflation continued accelerating in August. Both Pound and Euro are higher against the Dollar currently. USD/JPY reversed its advancing Monday while AUD/USD continued sliding with the Australian dollar higher against the Greenback currently while yen is lower.

Stock Market news

Futures on three main US stock indexes are up currently ahead of the Census Bureau housing data at 14:30 CET today. The three major Wall Street stock benchmarks ended solidly down Monday while Treasury prices rose as investors awaited central bank moves on tapering of its easy monetary policy, recording daily losses in the range of -2.19% to -0.1.7%.

European stock indexes are up currently after ending sharply lower Monday led by banking shares. Asian indexes are mixed today with Nikkei leading losses after Japanese markets reopened following a national holiday Monday. China Evergrande Group plummeted over 15% after earlier losing as much as 19% to over 11-year lows.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Gold Market News

| Gold USD | --- | --- | --- |

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

News

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Oil Prices Stay Weak After OPEC+ Approves Modest Output Rise

Oil prices ended the week on shaky ground after OPEC+ approved a modest production increase of 137,000 bpd, signaling cautious...

Slowing U.S. Growth Put Spotlight on CPI as EURUSD

Weak PMI data, softening jobs market, and political brouhaha raise the stakes for October’s inflation print. The U.S. government...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also