- Analytics

- Market Overview

Quotes boost continuation due to positive US statistics - 20.8.2014

World stock indices kept on rising on Tuesday. As expected, all the US macroeconomic data appeared to be positive. New Home Sales for July upped 15.7% and reached the 8-month high. The US Building permits added 8.1% and proved to be the highest since April 2013. Both indicators outperformed significantly the forecasts.

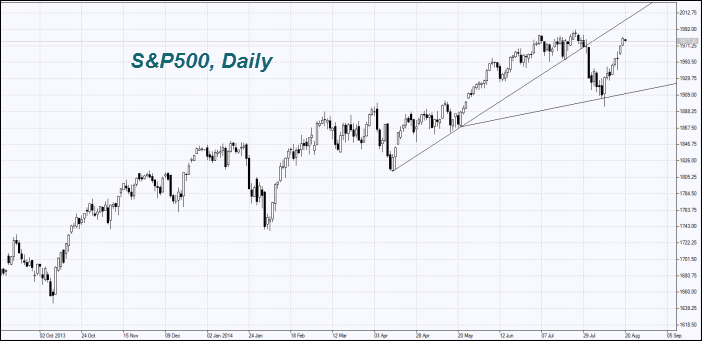

The July CPI slowed down to 0.1%, compared to the increase of 0.3% in June. It amounted to 2% in annual terms, and that level coincides with the Fed target level. S&P 500 climbed 3.8% from the 3-month low, which was observed on the 7 of August, but still has not renewed the July historical high. Out of the global indices only NASDAQ did that, which jumped to the highest level since March 2000. However, meanwhile the quotes increase is not confirmed by the profit growth of the corporations. Investors are buying stocks, longing for its further price growth and not paying enough attention to the financial statement performance of the companies. The current S&P 500 P/E ratio amounts to 17.8 and is considered to be the highest since 2000. Let us remind you that from the last long-term low in March 2009, S&P 500 rose 194% and did not show retracement of 10% or more over the 3 years. Apple stocks renewed its historical high yesterday (+1,4%). Investors expect the successful sales of the new products: iPhone with a bigger screen and a watch. Home Depot stocks climbed 4.7% after the positive earnings report release. Surprisingly enough, the American stock market rapid growth is still not gathering a large number of investors. The volume of trading on the US stock exchanges on Tuesday was again 14% lower than the 5-day average. The materials of the July Fed meeting is to be published today at 18:00 CET. In theory, markets may get a short break after a strong growth, and stay in the sideways trend for a couple of days, or even to correct slightly before the meeting of the central bank chairmen in Jackson Hole on Friday.

European stock prices are now slipping after a rapid 2-day growth. There were no special events in the EU, and the quotes have been rising along with the American stock market. Today, the beer producer Carlsberg reported a possible income reduction due to the declined demand for its products in Russia. There the company gets 35% of the revenue. Carlsberg stocks fell 6%, pulling the European stock markets down. It should be noted that there was more negative news from the smaller companies. Thus, the owner of the glasses manufacturer Luxottica Group decided to fire the CEO, which caused the quotes reduction by 4.7%. Euro-Zone Construction Output is to be released today at 9-00 СЕТ. We do not expect that the data will have a noticeable impact on the market being downward corrected.

Nikkei follows the European indices trends. Yesterday it rose, and today it has fallen. The data on July foreign trade in Japan contributed to the index fall; the data proved to be worse than expected. The imports increased 2.3%, despite the forecasted drop of 1.5%. For this reason, the foreign trade deficit upped to 964 billion yen compared to 823 billion yen in June. This is the worst historical value. Moreover, the deficit has been observed for 25 consecutive months. Note that there was considerable yen rate depreciation due to this statistics data. The weekly review on the deal volume of Japanese stocks and bonds by the Ministry of Finance will be published tomorrow early morning at 23-50 CET. Manufacturing PMI calculated by Markit/JMMA is to be released at 1-35 CET. The outlook seems to be positive.

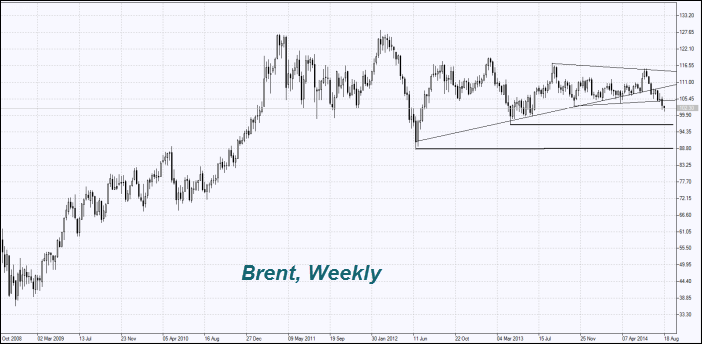

Oil prices are slightly increasing after a significant fall in the last few weeks. Brent price has already tumbled to the 14-month low. Previously, we have repeatedly pointed out that the decline in world oil prices is consistent to the Western sanctions against Russia. The weekly data on the US oil reserves is to be released today at 14-30 CET. According to the forecasts, they will be reduced by 1.75 million barrels. Gasoline inventories might fall by 1.55 million barrels and distillates, to 300,000 barrels. The statement made yesterday by the US President Barack Obama on the Iraq air strikes continuation has also contributed to the oil prices growth. Previously, Iraq was the second largest oil producer after Saudi Arabia in OPEC.

News

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also