- Analytics

- Market Overview

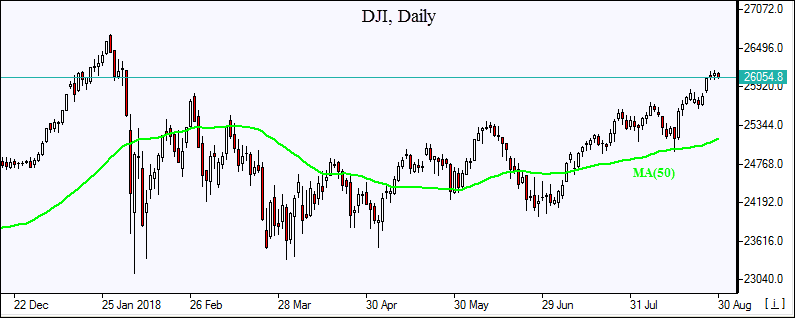

SP 500, Nasdaq log 4th straight record close - 30.8.2018

Dollar slips despite GDP upgrade

US stock market ended solidly higher on Wednesday on hopes Canada will join the US-Mexico trade deal. The S&P 500 climbed 0.6% to 2914.04. The Dow Jones industrial average rose 0.2% to 26124.57. Nasdaq composite index jumped 1% to 8109.69. The dollar weakening continued despite GDP upgrade: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.2% to 94.503 but is rising currently. Stock index futures indicate lower openings today.

Upbeat market sentiment endured on hopes the recently agreed US-Mexico deal will bring Canada, the third member of the North American Free Trade Agreement, on board by the Friday deadline. Economic data were mixed: the second quarter gross domestic product was revised upward from the 4.1% initial reading to 4.2% annualized rate, the fastest pace of expansion in almost four years. However July pending home sales showed a decline of 0.7% in July.

Main European indices open lower

European stocks resumed advancing on Wednesday on hopes of better progress on Brexit than anticipated . The GBP/USD joined EUR/USD climb and both pairs are higher currently. The Stoxx Europe 600 rose 0.3%. Germany’s DAX 30 ended 0.3% higher at 12561.68. France’s CAC 40 added 0.3% while UK’s FTSE 100 fell 0.7% to 7563.21. Markets opened flat to 0.3% lower today.

GBP/USD jumped 1.2% after news the European Union’s top Brexit negotiator Michel Barnier said the bloc was willing to offer the UK an unprecedented partnership, “such as has never been with any other third country.” Brexit negotiations resumed last Tuesday and the prospect of a “no-deal Brexit ”, when the final deadline of March 2019 for the UK exit could pass without any trade agreement ratified, has been a major drag on UK economy.

Asian indices mostly lower

Asian stock indices are mostly in negative territory today in thin trading. Nikkei ended 0.1% higher at 22869.50 despite a turn higher by yen against the dollar. China’s stocks are lower as China’s commerce ministry stated that trade issues with the United States can only be resolved through talks as equals: the Shanghai Composite Index is down 1.1% and Hong Kong’s Hang Seng Index is 1% lower. Australia’s All Ordinaries Index turned 0.01% lower despite sustained Australian dollar fall against the greenback.

Brent extends gains on US stocks drop

Brent futures prices are rising today. Prices jumped yesterday after the Energy Information Administration reported bigger than expected decline in crude stockpiles: US domestic crude supplies dropped by 2.6 million barrels last week when 1 million barrels fall was forecast by S&P Global Platts. Prices ended sharply higher yesterday: October Brent crude rose 1.6% to $77.14 a barrel on Wednesday.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also