- Analytics

- Market Overview

Stocks down ahead of megacap earnings - 31.10.2024

Todays’ Market Summary

- The Dollar weakening is intact

- The US stock index futures are down currently

- Gold prices are retracing lower

Top daily news

Global equity indexes are pointing mostly down currently ahead of Apple and Amazon quarterly reports after Wall Street ended lower on Wednesday. Microsoft shares slied 3.6% in after-hours trading after the software giant reported increased spending on artificial intelligence but slower growth in its cloud business Azure while the company beat Wall Street's estimates for quarterly revenue and profit, Meta shares slumped 3.18% on Wednesday in after-hours trading as the social media giant reported above expected revenue and earnings but Chief Executive Mark Zuckerberg pledged to keep up the company's big spending on AI and the metaverse.

Forex news

The Dollar weakening is intact currently. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.17% on Wednesday.

EUR/USD accelerated its advancing yesterday while GBP/USD reversed its climbing as flash data indicated that the euro zone economy grew 0.4% in the third quarter of 2024, above the 0.2% rise expected. Pound is higher against the dollar currently and euro is lower. USD/JPY ended little changed while AUD/USD reversed its sliding on Wednesday with both the yen and the Australian dollar higher against the Greenback currently.

Stock Market news

The US stock index futures are down currently ahead of unemployment claims data and Chicago Purchasing Managers' Indexes reports due at 16:30 CET and 17:45 CET respectively today. US stocks closed lower on Wednesday with the three main US stock benchmarks recording daily losses in a range from -0.56% to -0.22% led by tech shares as data showed the US gross domestic product increased at a 2.8% annualized rate below forecast of 3.0% while US private payrolls growth surged by a higher than expected 233,000 jobs in October.

European stock indexes futures are falling currently after closing lower on Wednesday with tech shares leading losses. Asian stock indexes futures are mostly lower today with Japan’s Nikkei leading losses as yen rose after Bank of Japan stood pat but noted that inflationary risks were "biased toward the upside" for next fiscal year.

Commodity Market news

| Brent Crude Oil | --- | --- | --- |

| Cotton | --- | --- | --- |

Brent is retracing down presently. Prices ended 2% higher yesterday after the US Energy Information Administration (EIA) report US crude oil stocks and gasoline inventories fell last week as imports slipped. There were also reports OPEC+, comprising the Organization of the Petroleum Exporting Countries and its allies such as Russia, could delay a planned oil production increase in December by a month or more because of concern over soft oil demand and rising supply. The US oil benchmark West Texas Intermediate (WTI) futures rose 2.08% but is lower currently. Brent crude added 2.01% to $72.55 a barrel on Wednesday.

Gold Market News

| Gold USD | --- | --- | --- |

Gold prices are retracing lower presently. Spot gold extended gains 0.46% to $2787.47 an ounce on Wednesday.

Crypto

| Bitcoin | --- | --- | --- |

| Ethereum - Dollar USA | --- | --- | --- |

News

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

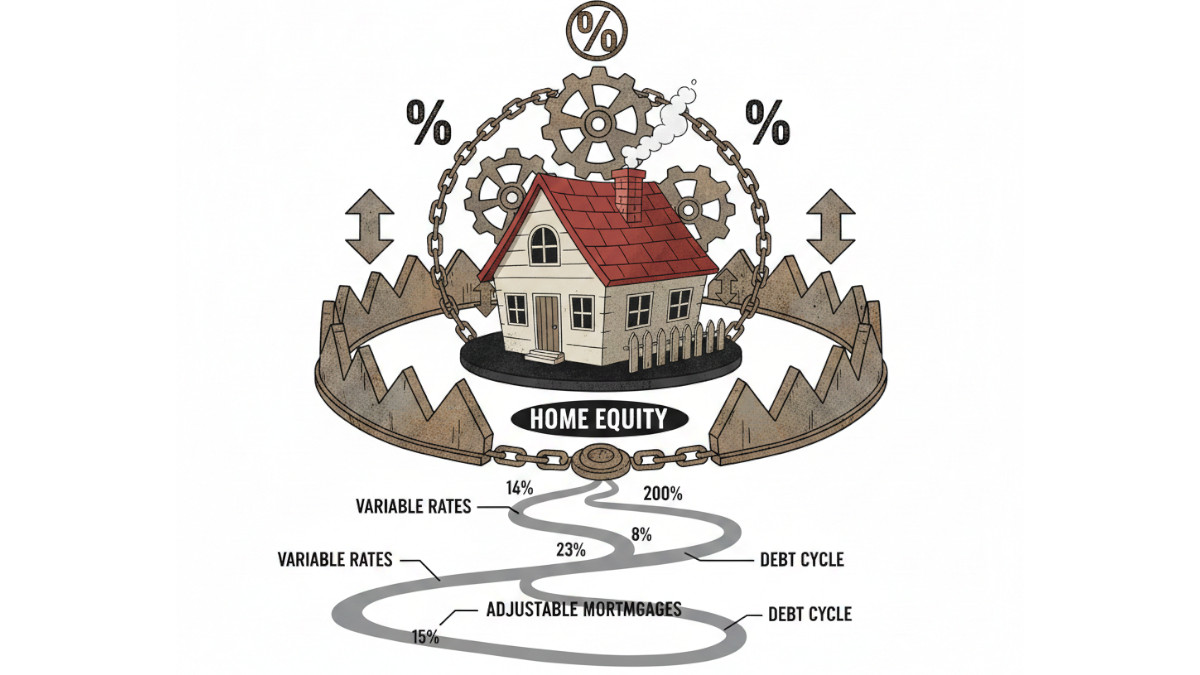

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also