- 分析

- 技術分析

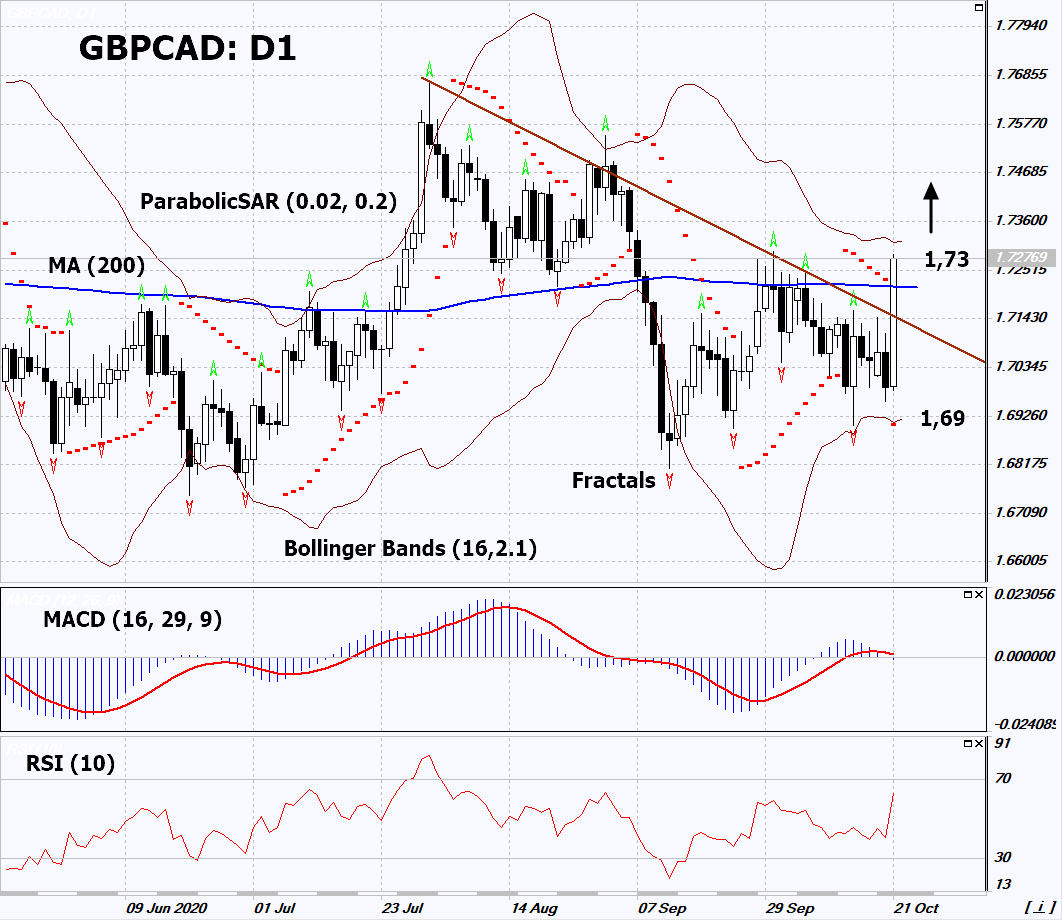

GBP/CAD 技術分析 - GBP/CAD 交易: 2020-10-22

GBP/CAD 技術分析總結

高於 1,73

Buy Stop

低於 1,69

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

| Bollinger Bands | 買進 |

GBP/CAD 圖表分析

GBP/CAD 技術分析

On the daily timeframe, GBPCAD: D1 breached up the resistance line of the short-term downtrend, as well as the 200-day MA. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish move if GBPCAD rises above the last three upper fractals: 1.73. This level can be used as an entry point. We can set astop loss below the 200-day moving average line, Parabolic signal, lower Bollinger line and last lower fractal: 1.69. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.69) without activating the order (1.73), it is recommended to delete the order: some internal changes in the market have not been taken into account.

外匯交易 基本面分析 - GBP/CAD

Canadian statistics probably indicate a slowdown in economic recovery. Will the GBPCAD quotes continue to grow?

An upward movement signifies the strengthening of the British pound and the weakening of the Canadian currency. The pound strengthened after the EU Council Head Michel Bernier's statement the EU would have to compromise on the Brexit talks to reach a mutual agreement. Investors also perceived a slight increase in inflation in Britain in September, as this may be a sign of economic recovery due to increased consumer demand. They are now awaiting the release of important data on UK retail sales for September and the Markit / CIPS Manufacturing PMI for October on Thursday and Friday this week. The forecasts are positive. In turn, the Canadian dollar weakened slightly amid risks of a decline in world oil prices and negative economic data. Canadian retail sales growth in August in monthly terms (+ 0.4%) was less than expected (+ 1.1%). A regular meeting of the Bank of Canada is scheduled for the next week. Investors fear it may take some measures to ease monetary policy in order to stimulate the Canadian economy.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.