- 分析

- 技術分析

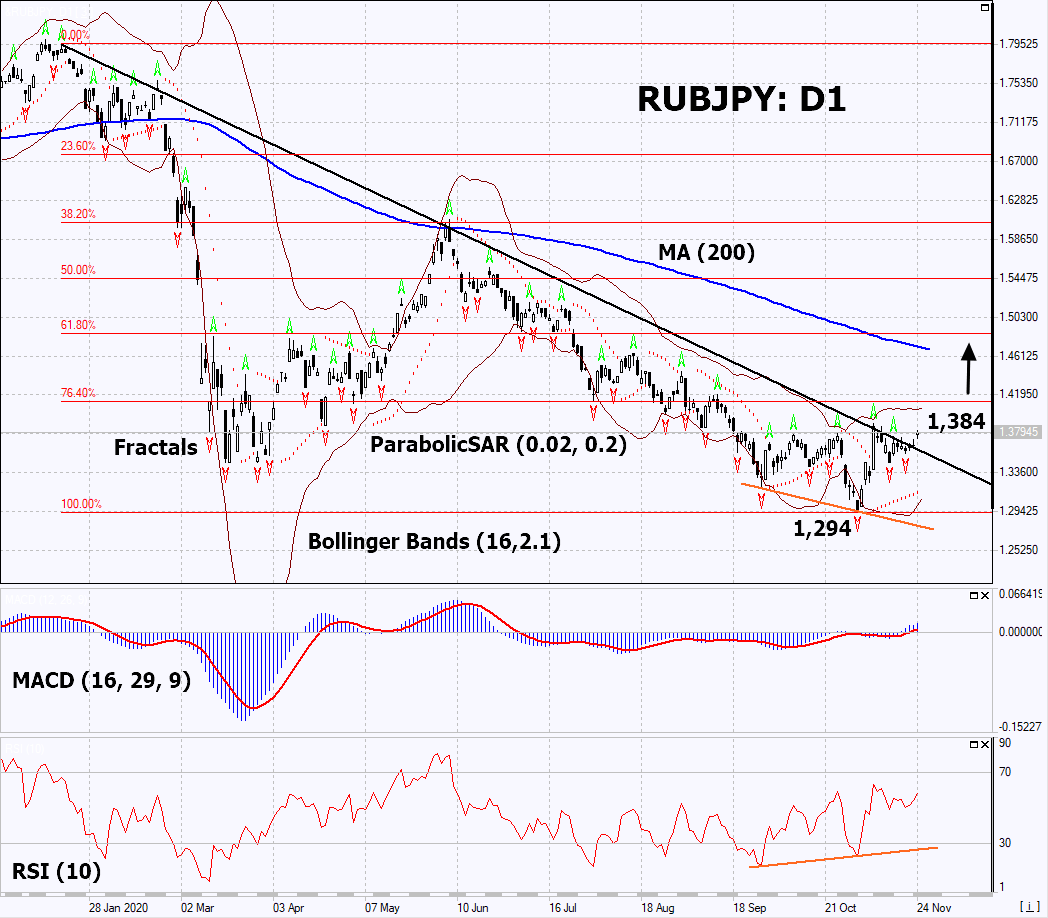

盧布對日元 技術分析 - 盧布對日元 交易: 2020-11-25

盧布對日元 技術分析總結

高於 1,384

Buy Stop

低於 1,294

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 買進 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

| Bollinger Bands | 中和 |

盧布對日元 圖表分析

盧布對日元 技術分析

On the daily timeframe, RUBJPY: D1 approached the downtrend resistance line. It must be broken upward before opening a position. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if RUBJPY rises above the last high: 1.384. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger band and all-time low: 1.294. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.294) without activating the order (1.384), it is recommended to delete the order: some internal changes in the market have not been taken into account.

PCI 基本面分析 - 盧布對日元

In this review, we propose to consider the RUBJPY personal composite instrument (PCI). It reflects the price dynamics of the Russian ruble against the Japanese yen. Will the RUBJPY quotes continue to increase?

The upward movement reflects the strengthening of the Russian ruble and the weakening of the yen. The ruble may strengthen amidst rising oil prices. Hydrocarbons account for approximately 70% of Russian exports. The yen may begin weakening against the background of the introduction of a coronavirus vaccine, since investors previously considered it a "safe have" currency. The Bank of Russia rate is 4.25% with 3.8% inflation in October, in annual terms. The Bank of Japan rate is -0.1% with October inflation of -0.4%, in annual terms. On November 27, Japan will release Tokyo inflation data for November, which may affect the dynamics of the yen. Russia’s trade surplus in September was $10 billion, and Japan’s - $6.3 billion (US dollar terms).

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.