- 分析

- 技術分析

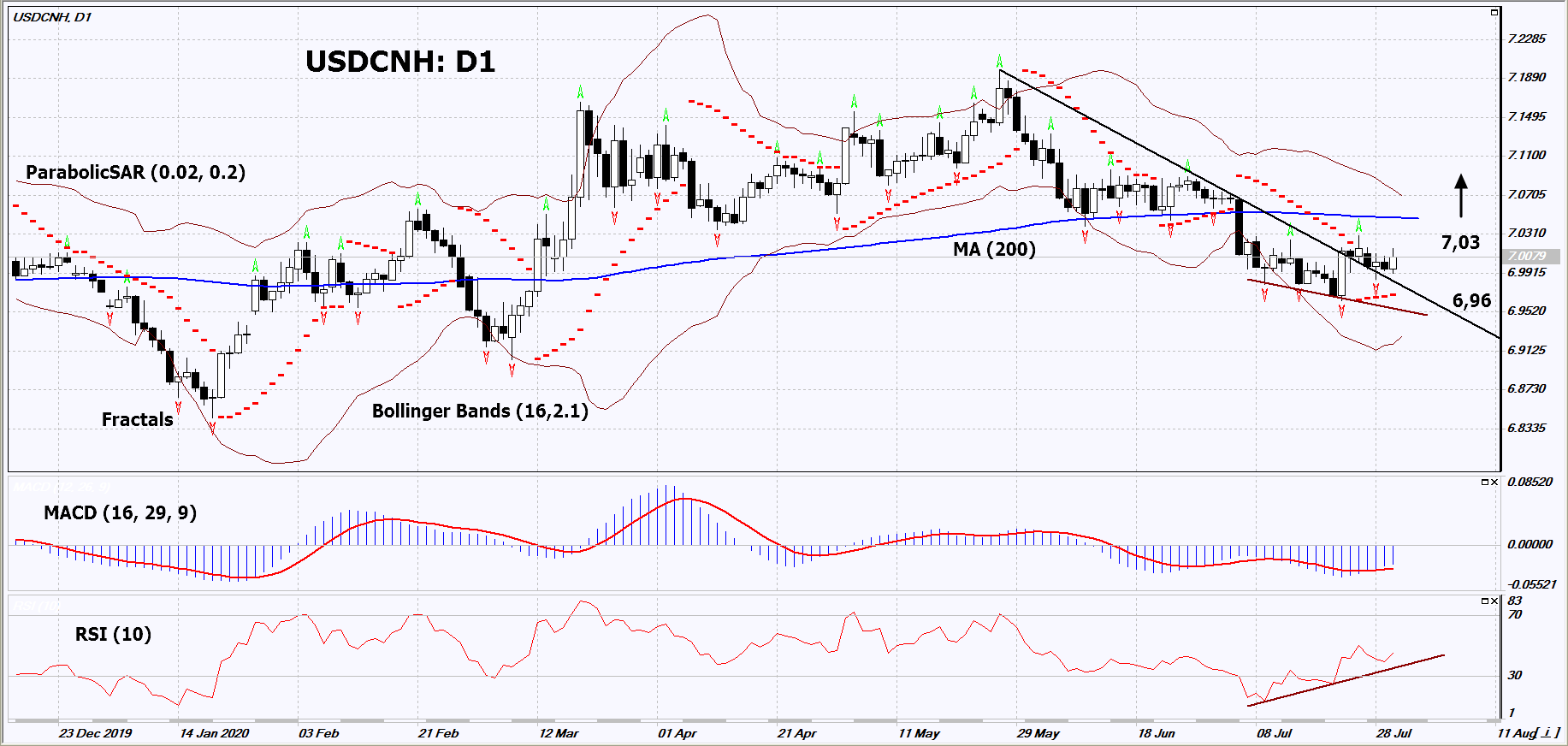

USD/CNH 技術分析 - USD/CNH 交易: 2020-07-31

USD/CNH 技術分析總結

高於 7,03

Buy Stop

低於 6,96

Stop Loss

| 指標 | 信號 |

| RSI | 買進 |

| MACD | 買進 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

| Bollinger Bands | 中和 |

USD/CNH 圖表分析

USD/CNH 技術分析

On the daily timeframe, USDCNH: D1 exited the downtrend. A number of technical analysis indicators formed signals for a further growth. We do not rule out a bullish movement if USDCNH rises above the last upper fractal: 7.03. This level can be used as an entry point. We can set a stop loss below the Parabolic signal and 2 last lower fractals: 6.96. After opening a pending order, we should move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop-loss, moving it in the direction of the trend. If the price meets the stop loss (6.96) without activating the order (7.03), it is recommended to delete the order: the market sustains internal changes that haven't been taken into account.

外匯交易 基本面分析 - USD/CNH

The US dollar rate began to strengthen slightly after the regular Fed meeting, at which no additional economic stimulus through emission was announced. Will the USDCNH quotations rise?

The upward movement means the strengthening of the US dollar against the Chinese yuan. At the last meeting on July 29, the Fed kept rates at 0-0.25% and left the parameters of its basic policy unchanged. Investors are awaiting statements from the US authorities, which are discussing another additional package of economic assistance in the amount of 1 - 3.5 trillion USD dollars. Along with the coronavirus pandemic, this is the main factor of pressure on the dollar. However, it should be noted that in recent times most American macroeconomic indicators are better than forecasts. Thus, the decline in GDP in the Q2 of this year amounted to 32.9%, while a decrease of 34.1% was expected. This may support the dollar, too. Possible new US sanctions on Chinese imports into the US could weaken the Chinese renminbi. On Friday morning, China will publish the NBS Manufacturing PMI, which may affect the renminbi’s rate.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.