- 分析

- 技術分析

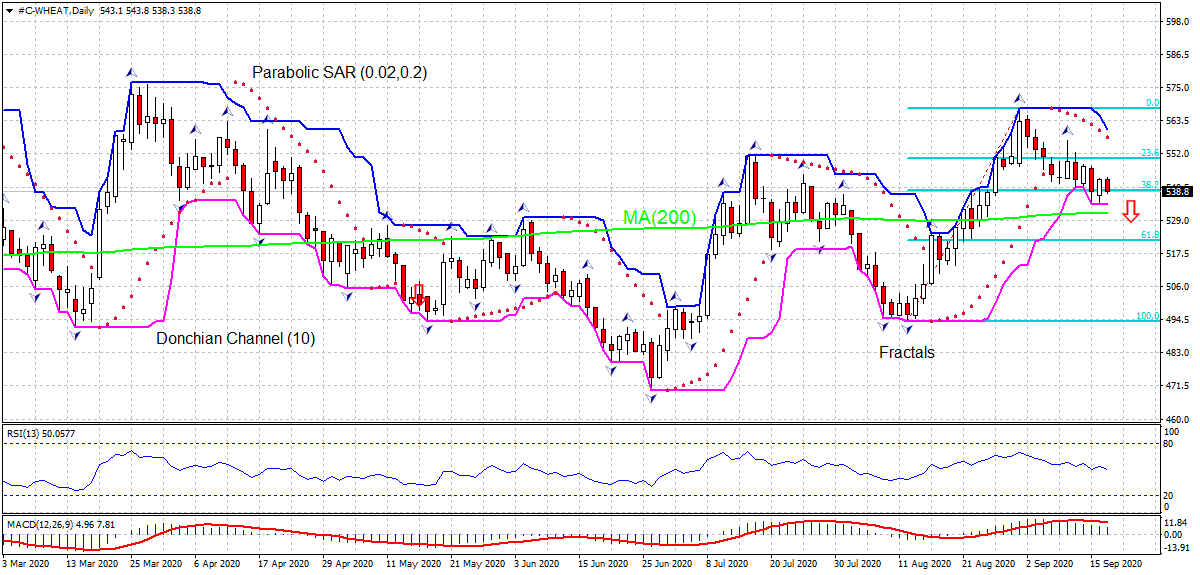

小麥 技術分析 - 小麥 交易: 2020-09-17

小麥 技術分析總結

低於 534.3

Sell Stop

高於 556.8

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| Donchian Channel | 賣出 |

| MA(200) | 買進 |

| Fractals | 賣出 |

| Parabolic SAR | 賣出 |

| Fibonacci | 買進 |

小麥 圖表分析

小麥 技術分析

On the daily timeframe the WHEAT: D1 is falling toward the 200-day moving average MA(200) which has levelled off. We believe the bearish momentum will continue as the price breaches below the lower Donchian boundary at 534.3. A pending order to sell can be placed below that level. The stop loss can be placed above 556.8. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

商品 基本面分析 - 小麥

Wheat price decline continues after increased global ending stock and production forecast in WASDE. Will the wheat price continue declining?

The US Department of Agriculture World Agricultural Supply and Demand Estimates September report a week ago forecast larger global 2020/21 supplies and higher stocks. Total 2020/21 net wheat production is now forecast at record 770.5 million bushels, up 4.5 million tons, mainly due to expected higher production in Australia and Canada. Projected 2020/21 world ending stocks are increased 2.6 million tons to a new record 319.4 million. Expectations of ample global wheat supply are bearish for wheat price.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.