- 分析

- 技術分析

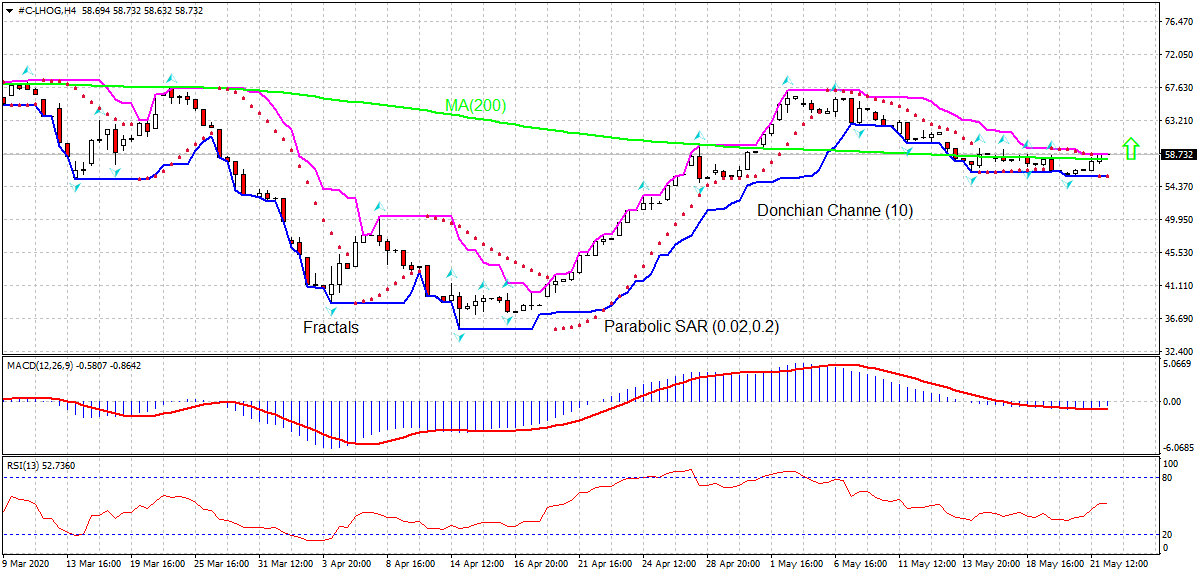

瘦豬肉 技術分析 - 瘦豬肉 交易: 2020-05-22

瘦豬肉 技術分析總結

高於 58.73

Buy Stop

低於 55.74

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 買進 |

| Donchian Channel | 中和 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 買進 |

瘦豬肉 圖表分析

瘦豬肉 技術分析

On the 4-hour timeframe #C-LHOG: H4 has breached above the 200-period moving average MA(200), which has levelled off. We believe the bullish momentum will continue as the price breaches above the upper Donchian boundary at 58.73. A pending order to buy can be placed above that level. The stop loss can be placed below 55.74. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (55.74) without reaching the order (58.73), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

商品 基本面分析 - 瘦豬肉

Lean hog price is rising supported by rising Chinese imports following US-China trade deal. Will the LHOG continue rebounding?

China’s pork deficit due to African Swine Fever (ASF) has resulted in rising Chinese pork imports. China imported 95,892 tons of US pork, up 250% from a year ago, according to the US Meat Export Federation. And while China is working to rebuild its pig herd, analysts estimate China’s pork imports will continue to rise this year. China’s reported Q1 pork imports are up 118% to nearly 1.2 million tons. The US accounts for 23% while the EU remains the primary supplier with a 61% market share. Rising Chinese imports are bullish for LHOG. However, US pork prices are pressured by increasing supply as meat processing plants restart after covid-19 shutdowns. At the same time demand is lower despite coming Memorial Day holiday next Monday. American pork slaughterhouses were operating through Wednesday at 85% of year ago levels as workers returned to plants. Wholesale pork prices climbed for the first time in four days but are still 18% below a five-year high of $121.66 per 100 pounds, according to US Department of Agriculture. Rising US supply and lower demand are downside risk for pork.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.