- 分析

- 市場情緒

Weekly Top Gainers/Losers: Australian Dollar and US Dollar

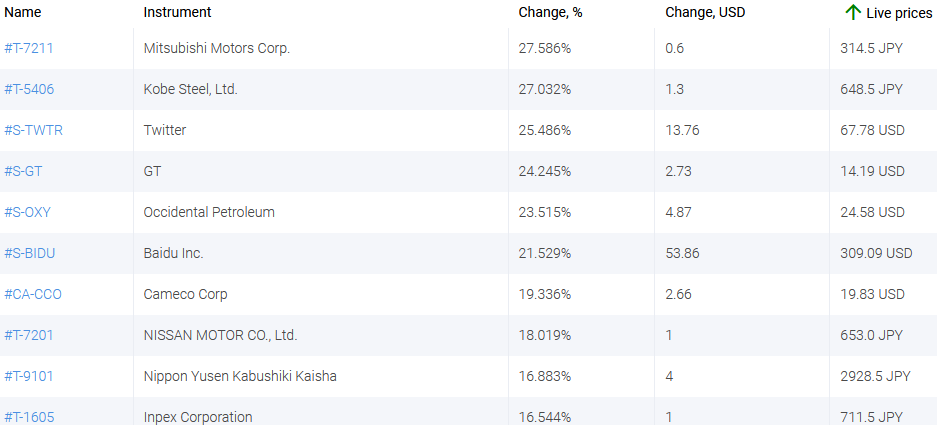

Top Gainers – The World Market

Top Gainers – The World Market

The US dollar weakened noticeably over the past 7 days. Investors fear a rise in inflation in the USA amid large-scale measures to stimulate the American economy. Against the backdrop of continued growth in global prices for oil, copper and non-ferrous metals, the commodity-based currencies such as the Russian ruble, the South African rand, the Australian dollar, the Norwegian krone have strengthened. The Turkish lira was supported by the increase in the rate of the Central Bank of Turkey at the end of 2020 to 17%. At the same time, the Central Bank of Turkey intends to keep high rates until 2023 and expects inflation to drop to 10% by the end of 2021.

1.Mitsubishi Motors Corporation, 27,6% – japanese automobile company

2. Kobe Steel, Ltd., 27% – japanese steel company

Top Losers – The World Market

Top Losers – The World Market

1. Origin Energy Ltd – Australian electricity and gas producer

2. Unilever PLC – British manufacturer of food and consumer products

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. AUDUSD, AUDJPY - the growth of these charts means the weakening of the US dollar and the Japanese yen against the Australian dollar.

2. AUDNZD, GBPNZD - the growth of these charts means the weakening of the New Zealand dollar against the Australian dollar and the British pound.

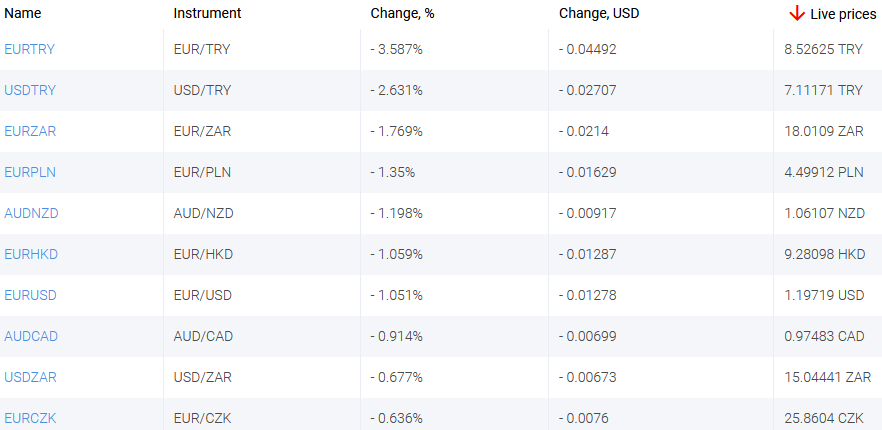

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. EURRUB, USDRUB - the drop of these charts means the weakening of the euro and the US dollar against the Russian ruble.

2. USDZAR, USDTRY, USDNOK - the drop of these charts means the weakening of the US dollar against the South African rand, Turkish lira and Norwegian krone.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.

最新市場情緒

- 3月18領漲/跌者: 加元和日元

在過去的7天裡,石油,有色金屬和其他礦物原料的價格雖然有所下降,但仍保持在較高水準。因此,商品貨幣有所加強:加元,澳大利亞和紐西蘭元,墨西哥比索和南非蘭特。在公佈負面經濟資料之後,日元走弱:貿易平衡,工業生產及該行業一系列商業活動資料。此外,日元受到日本銀行行長黑田東彥講話的負面影響,即日本的通貨膨脹不太可能在2024年達到+...

- 3月10Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 3月4領漲/跌者: 美元和南非蘭特

在過去的7天裡,石油價格持續上漲。 包括黃金在內的貴金屬價格下跌。 在這種背景下,石油公司的股票有所增加,俄羅斯盧布走強,澳大利亞和紐西蘭元以及南非蘭特走軟。 在美國政府債券收益率持續增長的推動下,美元走強。

...