- 分析

- 技術分析

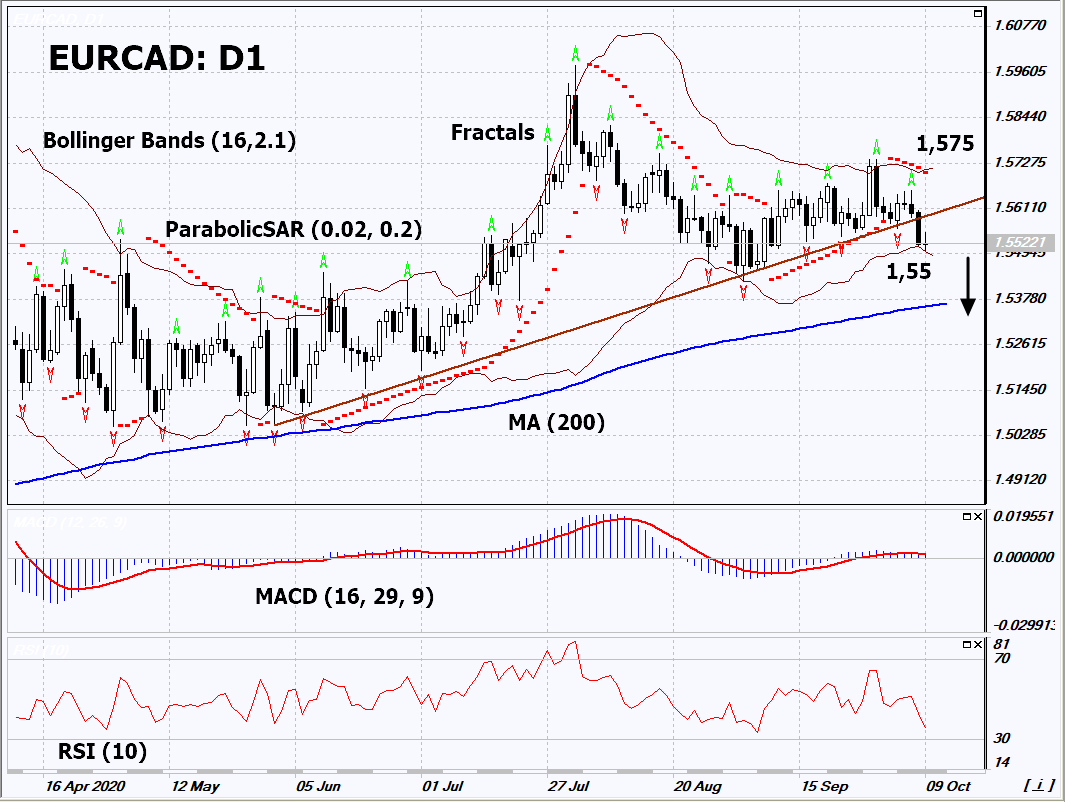

EUR/CAD 技術分析 - EUR/CAD 交易: 2020-10-12

EUR/CAD 技術分析總結

低於 1,55

Sell Stop

高於 1,575

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| MA(200) | 中和 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

| Bollinger Bands | 中和 |

EUR/CAD 圖表分析

EUR/CAD 技術分析

On the daily timeframe, EURCAD: D1 is correcting down from the maximum since February 2013. It broke down the uptrend support line. A number of technical analysis indicators generated signals for further decline. We do not exclude a bearish movement if EURCAD falls below the lower Bollinger band: 1.55. This level can be used as an entry point. We can place a stop loss above the last 2 upper fractals, the upper Bollinger band and the Parabolic signal: 1.575. After opening a pending order, we move the stop loss to the next fractal maximum following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.575) without activating the order (1.55), it is recommended to delete the order: some internal changes in the market have not been taken into account.

外匯交易 基本面分析 - EUR/CAD

Canada released positive data on the labor market. Will the EURCAD quotations continue to reduce?

Downward movement identifies the strengthening of the Canadian dollar against the euro. September unemployment rate in Canada fell to 9%, which is the lowest in half a year. This is better than expected (9.7%). The number of new job openings in Canada increased for the 5th month in a row. Relatively high world oil prices became an additional positive factor for the Canadian dollar. Even in spite of Friday's correction, oil gained about 10% over the week. In turn, the euro was affected by some negative news. The materials of the September ECB meeting contained information about its readiness for further monetary policy easing. Germany's foreign trade surplus in August amounted to 15.7 billion euros, which is worse than the forecast (18.2 billion euros). Industrial production in Germany in August fell by 0.2% compared to July, while an increase of 1.5% was expected.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.