- 分析

- 技術分析

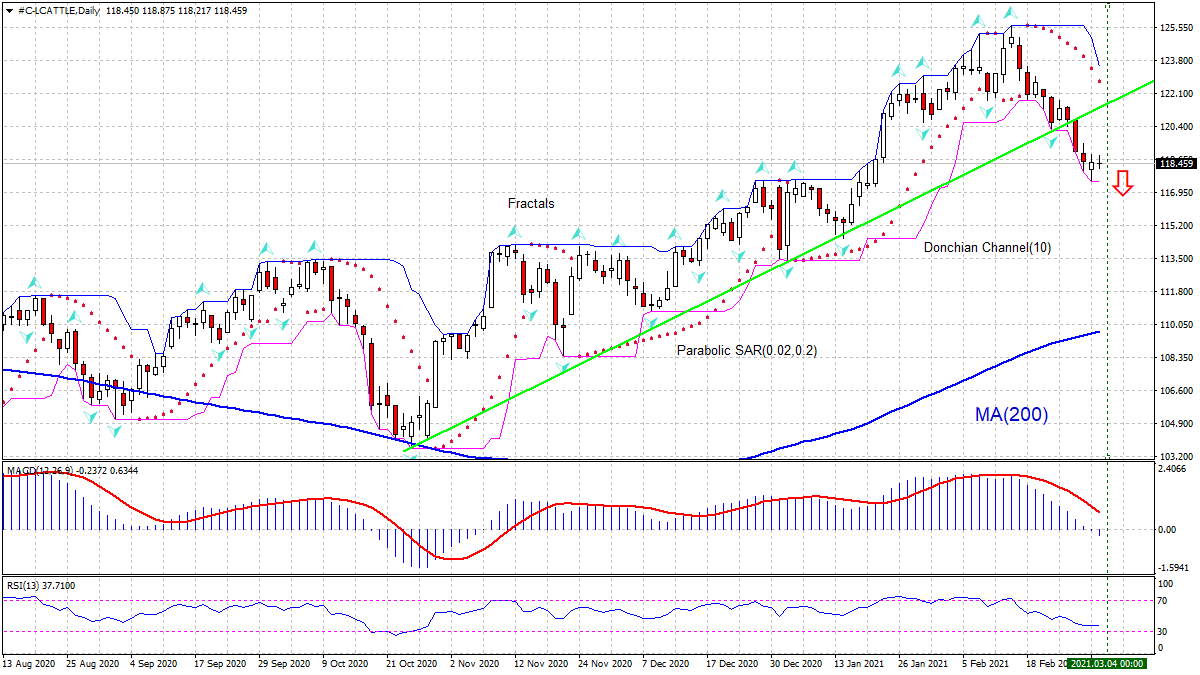

活牛 技術分析 - 活牛 交易: 2021-03-04

活牛 技術分析總結

低於 117.49

Sell Stop

高於 123.52

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| Donchian Channel | 賣出 |

| MA(200) | 買進 |

| Fractals | 中和 |

| Parabolic SAR | 賣出 |

活牛 圖表分析

活牛 技術分析

The #C-LCATTLE technical analysis of the price chart in daily timeframe shows #C-LCATTLE,Daily has fallen below the support line above the 200-day moving average MA(200), which is rising itself. We believe the bearish momentum will continue as the price breaches below 117.49. A pending order to sell can be placed below that level. The stop loss can be placed above 123.52. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

商品 基本面分析 - 活牛

US cattle slaughter volume rose last week. Will the LCATTLE continue falling?

Last week US cattle slaughter volume rose to 666,000 heads, approaching a high for this year to date, exceeding last year weekly average level by 38,000. The previous two weeks slaughter volumes were lower at 552,000 and 608,000 heads, creating a dip in supply. Higher slaughter volumes raise supply, which is bearish for live cattle price. At the same time analysts estimate meat packers could pay up to $144 per 100 lb without losing money, assuming a 1300 lb weight average for both steers and heifers. Higher demand from meat packers is an upside risk for price.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.