- 分析

- 技術分析

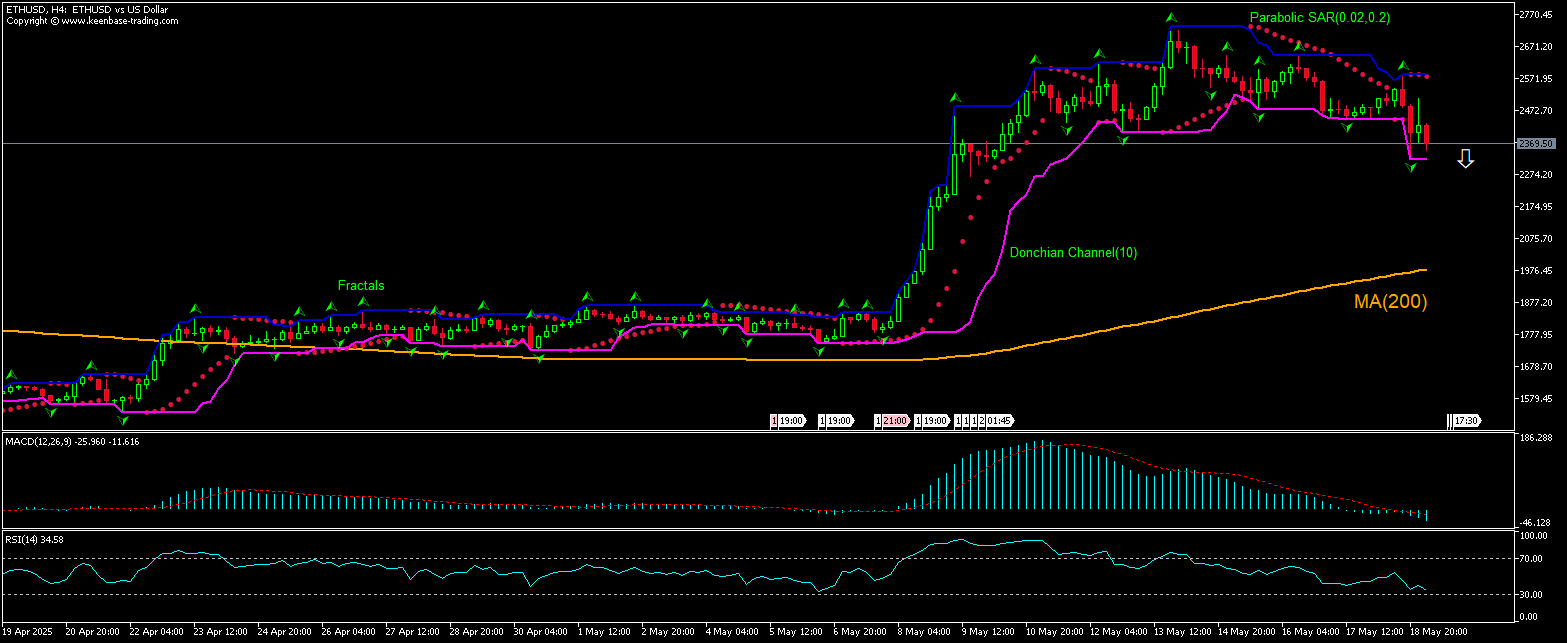

以太坊 / 美元 技術分析 - 以太坊 / 美元 交易: 2025-05-19

以太坊 / 美元 技術分析總結

低於 2121.87

Sell Stop

高於 2578.08

Stop Loss

| 指標 | 信號 |

| RSI | 中和 |

| MACD | 賣出 |

| Donchian Channel | 中和 |

| MA(200) | 買進 |

| Fractals | 賣出 |

| Parabolic SAR | 賣出 |

以太坊 / 美元 圖表分析

以太坊 / 美元 技術分析

ETHUSD 4 小时价格图表的技术分析显示,ETHUSD H4 在一周前反弹至三个月高点后,正朝着 200 期移动平均线 MA(200) 下跌。 我们认为,在价格跌破唐奇安通道下边界 2121.87 点后,看跌势头将持续。在此价位下方可作为挂单卖出的入场点。止损可设在 2578.08 以上。下单后,根据抛物线指标信号,将止损移至下一个分形高点。这样,我们就将预期盈亏比改为盈亏平衡点。如果价格达到止损位,但未达到订单,我们建议取消订单:市场发生了内部变化,而这些变化未被考虑在内。

加密貨幣 基本面分析 - 以太坊 / 美元

尽管最近一个月有鲸鱼积累的消息,但以太坊仍在下跌。ETHUSD 价格 会反转回撤吗?

今天有报道称,以太坊(ETH)“鲸鱼 ”在过去一个月中积累了超过 45 万个 ETH。按当前价格计算,这一大量积累的价值约为 13.5 亿美元,预示着 “鲸鱼 ”们对 ETH 的看涨情绪。然而,在过去六个交易日中,ETH 的交易价格一直在下跌,而同期加密货币大户比特币却徘徊在 103,000 美元左右。如果鉴于过去 30 天内鲸鱼积累了 45 万个 ETH,散户投资者的情绪也转为看涨 ETH,那么 ETH 的价格轨迹可能会扭转当前的下跌趋势,从而创造买入机会。然而,目前的情况对 ETHUSD 价格来说是看跌的。

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.