- 分析

- 領漲/跌者

Top Gainers and Losers: American and New Zealand dollars

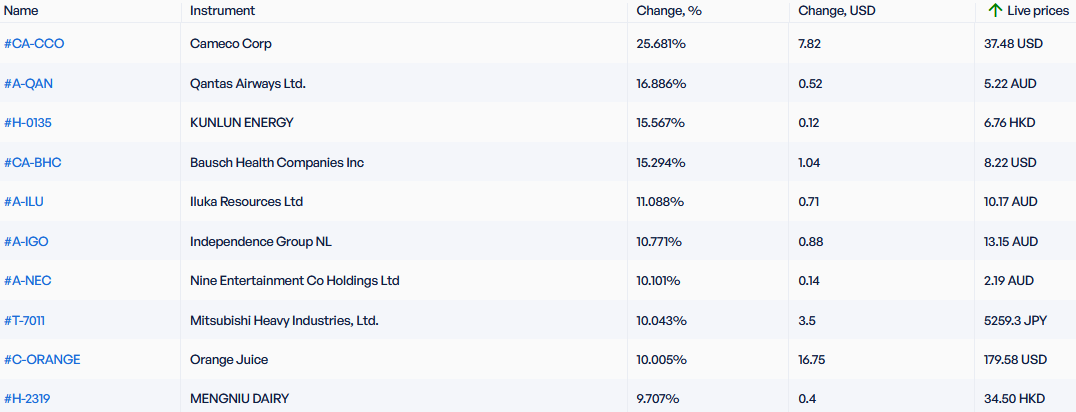

Top Gainers - global market

Over the past 7 days, the US dollar index rose and hit a 20-year high. This was facilitated by good economic statistics on the labor market from independent agencies ISM, ADP, Challenger and some others. Investors are looking forward to positive official data (United States Nonfarm Payrolls) for August, which will be released on September 2. The euro is supported by the plans of the European Central Bank to raise the rate (+0.5%) for the second time in a row at the meeting on September 8. The New Zealand dollar weakened amid the opinion of Adrian Orr (head of the Reserve Bank of New Zealand (RBNZ) that the rate hike slowed down the growth of the New Zealand economy. Recall that the RBNZ increased its rate 7 times in a row from 0.25% to 3%. Shares Tesla fell on the back of a reduction in subsidies for sales of electric vehicles in the US, in accordance with the Inflation Reduction Act, and a strong increase in electricity prices in the EU could also be a negative factor.

1. Cameco Corp, +25,7% – Canadian producer of uranium

2. Qantas Airways Limited, +16,7% – Australian airline

Top Losers - global market

1. Tesla Motors Inc. – American manufacturer of electric vehicles

2. EOSUSD – EOS cryptocurrency.

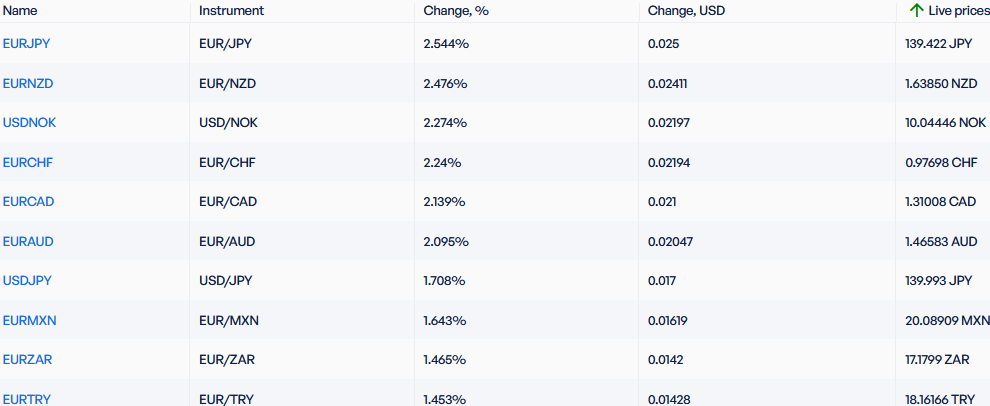

Top Gainers - foreign exchange market (Forex)

1. EURJPY, EURNZD - the increase in these charts means the strengthening of the euro against the Japanese yen and the New Zealand dollar.

2. USDNOK, EURCHF - the increase in these charts means the weakening of the Norwegian krone against the US dollar and the Swiss franc against the euro.

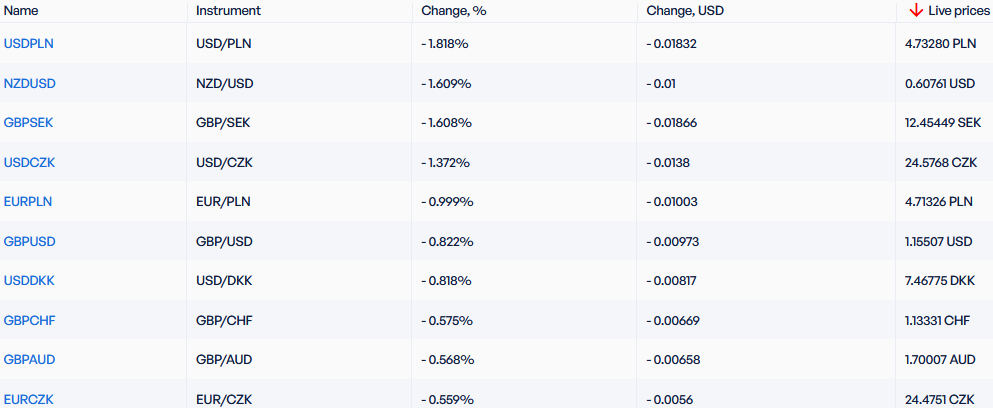

Top Losers - foreign exchange market (Forex)

1. USDPLN, USDCZK - the decline in these charts means the weakening of the US dollar against the Polish zloty and the Czech crown.

2. NZDUSD, GBPSEK - the decline in these charts means the strengthening of the US dollar against the New Zealand dollar and the strengthening of the Swedish krona against the British pound.

附注:

本文針對宣傳和教育, 是免費讀物. 文中所包含的資訊來自於公共管道. 不保障資訊的完整性和準確性. 部分文章不會更新. 所有的資訊, 包括觀點, 指數, 圖表等等僅用於介紹, 不能用於財務意見和建議. 所有的文字以及圖表不能作為交易的建議. IFC Markets及員工在任何情況下不會對讀者在閱讀文章中或之後採取的行為負責.

過往的贏家和輸家

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...